DESIGNING INNOVATIVE PEDAGOGY FOR COMPLEX ACCOUNTANCY TOPICS

The overall objective of the project is to address a gap in Higher Education by creating an internationally-oriented learning platform in accountancy that facilitates current essential hard and soft skill development for early career professionals.

Graduates planning to work in specialist areas of accountancy require specific competencies. They must develop sound subject-specialist knowledge, professional skills, and professional values, ethics and attitudes during their studies (IAESB, 2015). Such competence cannot be acquired through a didactic concept that involves only traditional lectures, seminars and modes of assessment.

The digital economy is growing much faster than the rest of the economy, but this potential is currently held back by a shortage of skilled graduates. Open vacancies for ICT practitioners cannot be filled, despite the high level of unemployment in Europe. The project will help to close this gap (shortage of up to 900 000 ICT professionals by 2020).

Due to the COVID-19 pandemic the project has been prolonged till December 2021. Now our cases are finalized and available for free (Download Cases). For interested teachers all materials are available using that link: Request for Instructors

More information on this good practice project can also be found on the Erasmus+ Website.

Objectives

We aim to develop a teaching concept that facilitates the development of all competencies to meet the current and future demands in the Profession and significantly enhance the employability of engaged students. The technological changes in the profession require graduates to be more digitally competent, commercially and internationally aware, analytical and resilient. The teaching concept will take the changing environment into account. Working as an accountancy professional requires interdisciplinary thinking and problem-solving skills, as well as understanding accountancy in different cultures and legislations.

Project Results

There will be four distinct but integrated sets of case studies with underlying text and online learning materials including two databases. The topics of cases address areas of global and immediate concern, the titles of which are:

IO1 - Combating Aggressive Tax Planning Strategies, Post-BEPS

IO2 - From a story teller to a modelling expert: changing requirements for the accounting of financial instruments

IO3 - Digitalization in Auditing

IO4 - Developing Integrative Learning Resources to examine links in Corporate Governance Mechanisms and tax avoidance practices fostering socially responsible behaviour of companies

Project Partners

The Partners of this project have a long history of working together in the development of teaching materials, intensive study programmes, student and staff exchanges, research and other knowledge exchange. We received an EXCELLENT rating and very positive feedback ("...very systematic and excellent...") from the Austrian National Agency on the completion of our joint project: International Learning Platform in Accountancy (ILPA), Project number: 2014-1AT01-KA203-000965. We intend to deliver another excellent project that will be innovative, open access and widely used.

Partners’ contacts in accounting firms and finance departments of corporations (groups) will be consulted during the project for subject-specific assistance. The applicant and the other partners have close contacts within the Big Four, MNEs and the Professional and Statutory and Regulatory Bodies (e.g. ICAEW, ACCS, CIMA) in the respective countries. This will ensure the professional relevance and practical application of the learning material which will, in turn, enhance the student experience. The combined subject expertise and the dedication and enthusiasm in academia of the partners far exceeds the sum of their individual contributions. The richness of past projects that have been developed during the association spanning more than two decades are a testament to the benefit of the extended global network. What we are able to harness through our extended, multi-national network mimic the scenarios and complex issues MNEs face today.

The DIPCAT project kick-off took place in Kavala in September 2018. Within the two working days, the project team defined the most important steps for the next three years to conduct another successful Erasmus+ strategic partnership.

Vigo (Spain), June 2019

For preparing the first ISP (Intensive Study Programme) in September 2019 the second DIPCAT project meeting took place in Vigo (6.-8. June). The Universidade de Vigo was hosting the meeting; Prof. Dr. Belén Fernandez-Feijoo and Prof. Dr. Phyllis Alexander were leading the productive meeting.

Within the meeting, we clarified various administrative issues and we agreed on holding the 2nd ISP in Innsbruck in September 2021.

Timisoara (Romania), May 2020 (online)

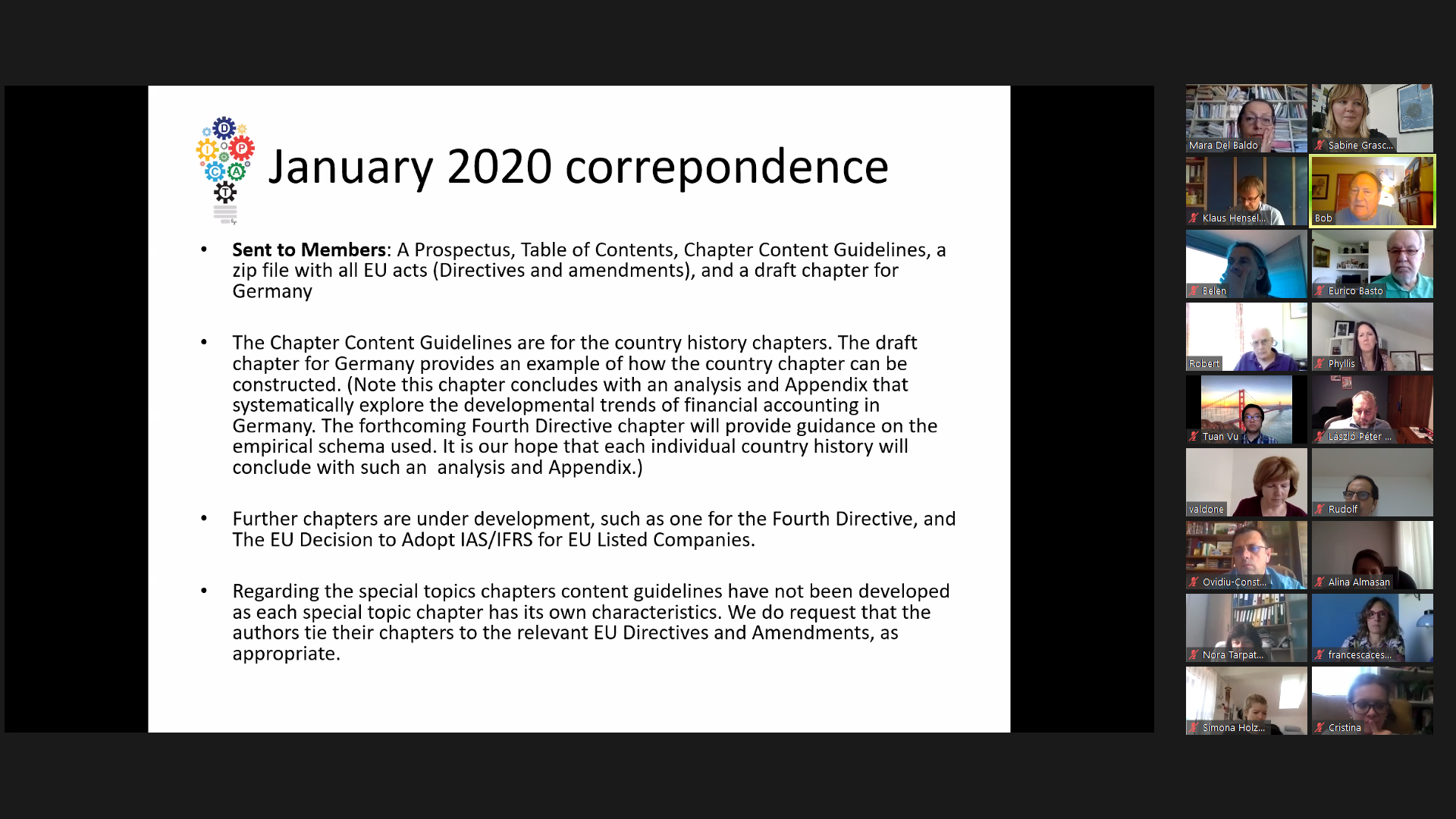

The virtual project meeting of the DIPCAT consortium took place on May 25th and 26th. Due to the current travel restrictions, the meeting could not take place in Timisoara (Romania), but was held via zoom.

The 25 participating professors from 13 countries met on both days for constructive and productive discussions. From Innsbruck, Rudolf Steckel, Sabine Graschitz and Simona Holzknecht were there. Overall, the further “timetable” for the project was discussed.

In addition, we actively worked on the book project “The Modern History of Accounting in Europe”.

Although the meeting was only held virtually, one or two snapshots of the project meeting could be taken.

Bournemouth (England), May/June 2021 (online)

INTENSIVE STUDY PROGRAMMES AND MULTIPLIER EVENTS

1st ISP Bournemouth (England), September 2019

The first DIPCAT-ISP took place in Bournemouth (UK). About 70 students from 12 European countries and the US participated in the ISP. Among them, also 9 students from the Master course "Accounting, Auditing and Taxation". The event was organized by Prof. Dr. Phyllis Alexander and her team from Bournemouth University.

The ISP aimed to conduct a first trial of the learning platform developed throughout the DIPCAT project. The case study based approach tackled topics from IFRS 9, International Taxation, CSR-Reporting and Tax Avoidance, as well as Digitalisation of Auditing. Besides the case studies a social programme including a Pub Quiz, a zip wire ride and a visit in the Russell-Cotes museum was organized (official program of the ISP).

The event started with various country and group presentations of the participating students. Austrian students presentted themselves using this "Ignite-Style" presentation.

For the participating academics a Research Symposium was organized. Every day a different workshop was organized, dealing with Bid-Writing, a introduction into Computerized Textual Analysis of Non-Financial Disclosure with Rapidminer, a round table dealing with the "Modern History of European Accounting" and a Open Research Workshop took place to foster the cooperation and enhance the scientific exchange between the academics.

The event was a big success. This was also captured within a short video. The Austrian students' reported on their experience within a short report:

Report Bournemouth DIPCAT 2019

Thanks to all participating countries Further pictures are available on the DIPCAT homepage

1st virtual ISP Innsbruck (Austria), September 2021

In September 2021 the first virtual Intensive Study Program was organized. 80 students from 11 different European countries as well as 30 lecturers participated in the virtual event. 15 participating students of the master program "Accounting, Auditing and Taxation" were able to deepen their knowledge in the field of international taxation as well as corporate social responsibility. The one-week ISP was organized by Univ.-Ass. Sabine Graschitz and her team at the University of Innsbruck.

The aim of the event was to solve complex case studies in international teams. Students were challenged to find solutions and to present them afterwards. Through various group constellations in the course of the event, it was ensured that students could exchange their ideas with national and international students. If necessary, students were supported by the lecturers in solving the tasks. In addition to the technical program, students from the different countries were able to network through social exchange in the form of an online Escape Game. In addition, the participants from the University of Innsbruck were able to exchange ideas during a dinner and a hike.

Further information regarding the event can be found in the report below. In addition, participants of the ISP shared their experiences on social media.

Report: report-dipcat-project-innsbruck.pdf

2nd ISP Budapest (Hungary), October 2021

In October 2021 the second virtual Intensive Study Program was hosted by the Corvinus University in Budapest. Five students of the master program "Accounting, Auditing and Taxation" of the University of Innsbruck participated. They were able to expand their knowledge by solving complex case studies in the field of financial accounting and auditing.

The first case study dealt with the topic IFRS 9 and the expected credit loss model. In advance the organizors provided teaching material for the students. The assignments can be found on the DIPCAT homepage. Subsequently, the students presented their work in the so-called plenary session. The second focus of this ISP was auditing. In international group constellations, the students dealt with the aspects of digitalization, possibilities of using Excel for audits and the audit principles. Therefore, they used they used the programs Notepad++, RapidMiner and Excel. Through their use, students were able to familiarize themselves with the programs and identified the advantages.

The students found the elaboration of the extensive case studies challenging and, in their opinion, contributed to an improvement of their didactic skills. Furthermore, they were able to expand their knowledge by using different virtual collaboration programs. A major success factor of the Intensive Study Program is the cooperation on an international level. In addition to the exchange in English, the teams consistently benefited from the different ways of thinking.

Report: report-dipcat-budapest-2021.pdf

After the end of the project period and the holding of the three planned Intensive Study Programmes, the Erasmus+ partnership was assessed with best marks. Overall, the project was very well implemented and achieved good results. By describing the project objectives of developing cognitive, interpersonal and practical skills for accounting graduates, the relevance was clearly demonstrated:

“Overall, this project was well delivered and achieved good results. The final report describes in a good way the relevance of the project by identifying the aims: develop cognitive skills, interpersonal skills, and practical skills for accountancy graduates.”

In addition, good project management, clear use of the budget and good presentation of teaching activities and student participant profiles were also highlighted.

“There is good information about the quality, effectiveness and efficiency of the project monitoring and evaluation. Budget control and time management are well described. The information provided about the learning/teaching/training activities and the participants’ profiles is well defined, and there’s clear information about the selection and evaluation of the activities.”

The participating students also gave very positive feedback on the DIPCAT partnership and the Intensive Study Programmes. They found the case studies very demanding and challenging and were able to take away a lot for their future professional life. In particular, the focus on digitalisation and the use of various digital tools was viewed extremely positively.

Even during the project period of the DIPCAT partnership, most of the partner universities have already started the next Erasmus+ funded strategic partnership with STAMP-online. Thus, students of the University of Innsbruck will also have the opportunity to participate in international Intensive Study Programmes in the coming years. The next ISP within the framework of STAMP-online will take place in Innsbruck in July 2023.

|

BOURNEMOUTH UNIVERSITY United Kingdom (Koordinator) UNIVERSITAET INNSBRUCK Austria FRIEDRICH-ALEXANDER-UNIVERSITAET ERLANGEN NUERNBERG Germany TECHNOLOGIKO EKPEDEFTIKO IDRIMA ANATOLIKIS MAKEDONIAS & THRAKIS Greece BUDAPESTI CORVINUS EGYETEM Hungary ISM VADYBOS IR EKONOMIKOS UNIVERSITETAS UAB Lithuania INSTITUTO POLITECNICO DO PORTO Portugal UNIVERSIDAD DE VIGO Spain UNIVERSITATEA DE VEST DIN TIMISOARA Romania Universita' degli Studi di Urbino Carlo Bo Italy UNIVERSITE DU LUXEMBOURG Luxembourg UNIVERSITE DE BRETAGNE SUD |

|

Univ.-Prof. Dr. Rudolf Steckel

Univ.-Ass. Dr. Sabine Graschitz

Univ.-Ass. Simona Holzknecht, MSc

Official Homepage: