DESIGNING INNOVATIVE PEDAGOGY FOR COMPLEX ACCOUNTANCY TOPICS

Als Nachfolgeprojekt für ILPA wurde 2018 die Idee zur strategischen Partnerschaft „Designing Innovative Pedagogy for Complex Accountancy Topics“ geboren. Nach der Einreichung im März durch die Bournemouth University erhielten wir Anfang Juli die Genehmigung des Projekts. Unter Leitung der Bournemouth University sollen in den nächsten 3 Jahren weitere innovative Lehrkonzepte für den Bereich Accountancy entwickelt werden. Besonders innovativ ist das Projekt durch die Integration der Bereiche Steuern, Rechnungslegung und Bewertung von Finanzinstrumenten, Abschlussprüfung mit und ohne IT-Unterstützung, Corporate Governance, Corporate Social Responsibility Reporting sowie ethische Aspekte all dieser Themenbereiche.

Aufgrund der Corona-Krise wurde das Projekt bis Dezember 2021 verlängert. Die Cases sind nun finalisiert und sind für Lehrveranstaltungen frei verfügbar (Download Cases). Interessierte Lehrende erhalten über den folgenden Link Zugang zu den gesamten Lehr- und Lernmaterialien: Anfrage Instructors

hier finden sich weitere Infos über das Projekt:

Und auch auf der Website von Erasmus+ können weitere Infos zum Good Practice-Projekt abgerufen werden.

Finale Beurteilung der Gutachter

Kavala (Griechenland), September 2018

Bei der Veranstaltung wurde neben dem Abklären organisatorischer Details auch die weitere Vorgehensweise bei der Entwicklung der Projektergebnisse besprochen. Ferner wurde festgehalten, dass das zweite ISP im September 2020 in Innsbruck stattfinden wird.

Hierzu wird es im Sommersemester 2020 Infoveranstaltungen geben, um unsere Masterstudierenden Informationen über die spannende Veranstaltung geben zu können. Details sowie Infoveranstaltungen hierzu wird es voraussichtlich im April/Mai 2020 geben.

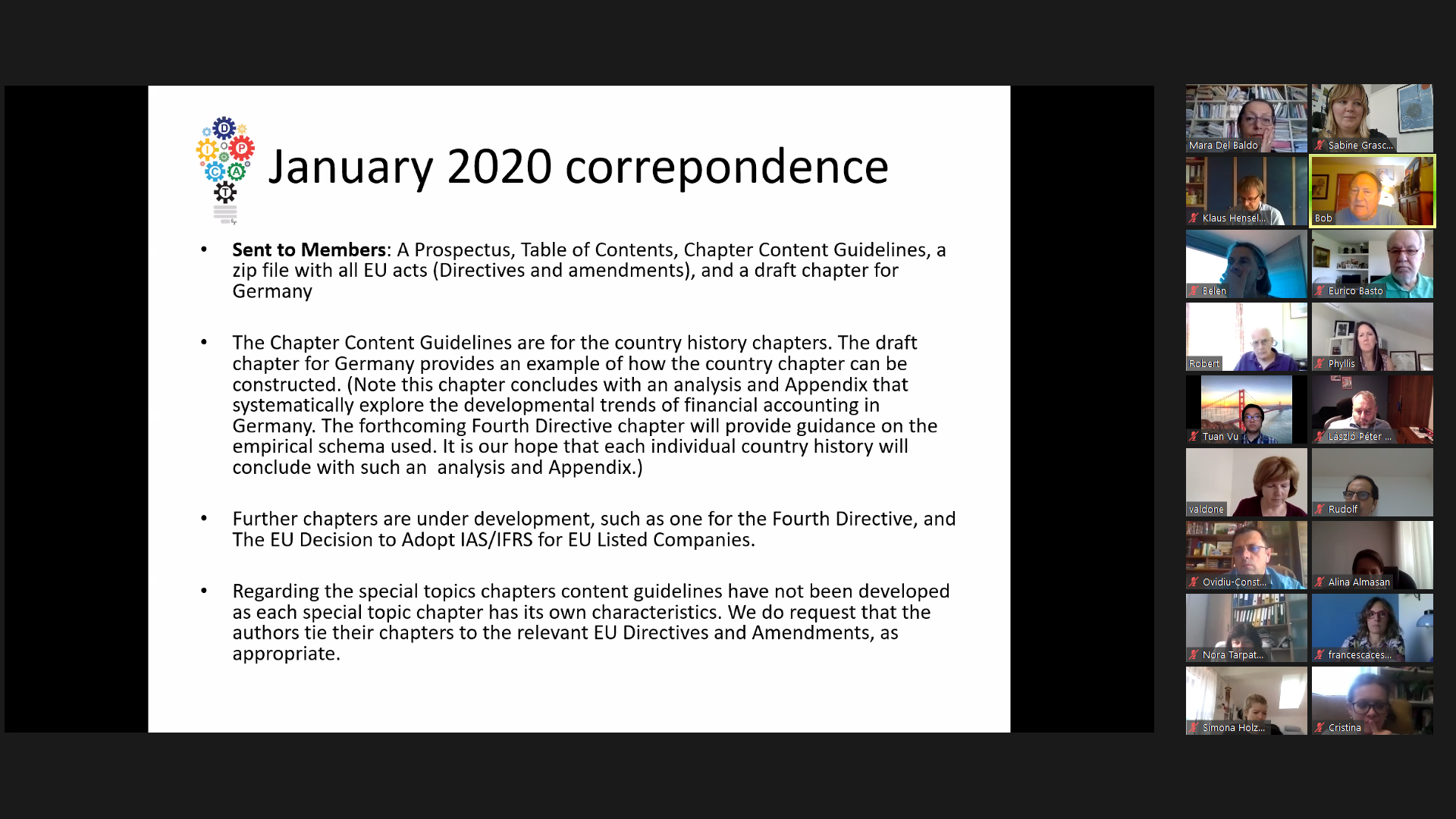

Am 25. Und 26. Mai fand das virtuelle Projektmeeting des DIPCAT-Konsortiums statt. Aufgrund der aktuellen Reisebeschränkungen konnte das Meeting nicht in Timisoara (Rumänien) stattfinden, sondern wurde via Zoom abgehalten.

Die 25 teilnehmenden Professorinnen und Professoren aus 13 Ländern trafen sich an beiden Tagen zu konstruktiven und produktiven Besprechungen. Aus Innsbruck waren Rudolf Steckel, Sabine Graschitz und Simona Holzknecht mit dabei. Insgesamt wurde dabei der weitere „Fahrplan“ für das Projekt beschlossen.

Zudem wurde auch aktiv am Buchprojekt „The Modern History of Accounting in Europe“ gearbeitet.

Obwohl das Meeting nur virtuell abgehalten wurde, konnte der ein oder andere Schnappschuss vom Projektmeeting gemacht werden.

Bournemouth (England), Mai/Juni 2021 (online)

INTENSIVE STUDY PROGRAMMES AND MULTIPLIER EVENTS

Vom 1. Bis 7. September fand in Bournemouth (UK) das erste Intensive Study Programme (ISP) der Erasmus+ strategischen Partnerschaft statt. Unter den 70 teilnehmenden Studierenden aus 13 europäischen Ländern und den USA waren auch 9 Studierende des Masterstudiengangs „Accounting, Auditing and Taxation“. Organisiert wurde das ISP von Prof. Dr. Phyllis Alexander und ihrem Team von der Bournemouth University.

Die Veranstaltung wurde zum großen Erfolg und von den Studierenden positiv beurteilt. Somit wird durch die Veranstaltung eine erfolgreiche Geschichte von Intensive (Study) Programmes der letzten 25 Jahre fortgesetzt. Die Veranstalter haben die Eindrücke auch in einem kurzen Video festgehalten. Das Feedback unserer Studierenden wurde in zwei Berichten festgehalten ( 1. DIPCAT Erfahrungsbericht Bournemouth 2. DIPCAT Erfahrungsbericht Bournemouth).

Wir danken den Veranstaltern, allen Projektpartnern, aber insbesonder allen Studierenden für die erfolgreiche Zusammenarbeit. Weitere Informationen können auf der DIPCAT Homepage entnommen werden.

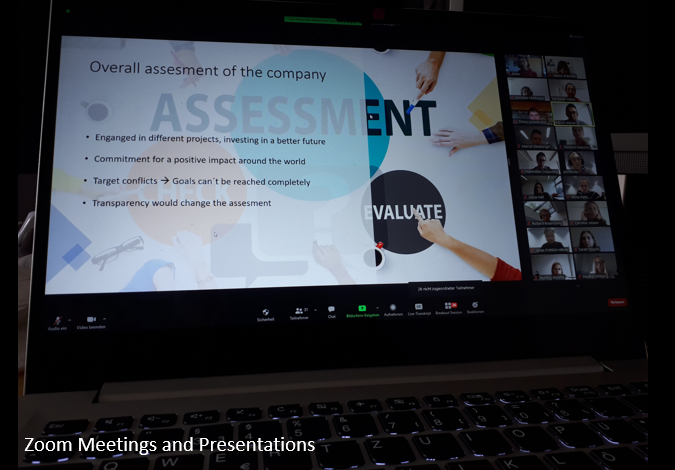

Vom 13. bis zum 17. September 2021 fand in Innsbruck das erste virtuelle Intensive Study Programme statt. 80 Studierende aus 11 verschiedenen europäischen Ländern sowie 30 DozentInnen nahmen an der virtuellen Veranstaltung teil. 15 teilnehmende Studierende des Masterstudiengangs „Accounting, Auditing and Taxation“ konnten dabei ihr Wissen im Bereich Internationale Steuerlehre sowie Corporate Social Responsibility vertiefen. Die Organisation des einwöchigen ISPs wurde von Univ.-Ass. Sabine Graschitz und ihrem Team der Universität Innsbruck durchgeführt.

Ziel der Veranstaltung war es dabei komplexe Fallstudien in internationalen Teams zu lösen. Studierende waren dabei gefordert gemeinsam Lösungen zu finden und diese im Anschluss zu präsentieren. Durch verschiedenste Gruppenkonstellationen im Laufe der Veranstaltung wurde gewährleistete, dass sich Studierende sowohl national als auch international austauschen konnten. Studierende wurden bei Bedarf bei der Lösung der Aufgabenstellungen von den Dozenten unterstützt. Neben dem fachlichen Programm konnten sich die Studierende aus den verschiedenen Ländern durch den sozialen Austausch in Form eines online Escape Games vernetzen. Zudem konnten sich die TeilnehmerInnen der Universität Innsbruck im Rahmen eins gemeinsamen Abendessens sowie einer gemeinsamen Wanderung austauschen. Aufgrund der Covid-19 Pandemie konnte die Veranstaltung nicht wie geplant in Präsenz stattfinden. Dennoch konnten Studierende durch die Verwendung unterschiedlichster Meeting Tools effizient zusammenarbeiten.

Weitere Informationen bezüglich der Veranstaltung können im nachstehenden Bericht entnommen werden. Zudem teilten TeilnehmerInnen des ISPs ihre Erfahrungen auf Social Media.

Bericht der Studierenden: dipcat-september-2021---erfahrungsbericht.pdf

Das zweite virtuell stattfindende Intensive Study Programm wurde im Oktober 2021 von der Universität Corvinus in Budapest (Ungarn) ausgerichtet. Fünf Studierende des Masterstudiengangs „Accounting, Auditing and Taxation“ der Universität Innsbruck nahmen an der Veranstaltung teil. Dabei konnten diese durch die Lösung von praxisrelevanten Themenstellungen, im Bereich Financial Accounting und Audit, ihr Wissen erweitern. Eine Durchführung der Veranstaltung in Präsenz war aufgrund der geltenden Corona Maßnahmen nicht möglich. Nichtsdestotrotz konnten sich die teilnehmenden Studierenden virtuell miteinander vernetzen und bewerteten die Veranstaltung als äußerst gelungen.

Die Bearbeitung der ersten Fallstudie setzte sich mit der Thematik IFRS 9 und des Expected Credit Loss Modells auseinander. Studierende konnten sich bereits vor Veranstaltungsbeginn mit Hilfe der Bereitstellung von Lehrmaterialien Wissen in diesem Bereich aneignen. Die genaue Aufgabenstellung kann auf der DIPCAT Homepage entnommen werden. Ausarbeitungen wurden im Anschluss von den Studierenden in der sogenannten Plenary Session präsentiert. Der zweite Themenschwerpunkt dieses ISPs setzte sich mit der Thematik Wirtschaftsprüfung auseinander. In internationalen Gruppenkonstellationen beschäftigten sich die Studierenden unter anderem mit den Aspekten Digitalisierung, Möglichkeiten des Einsatzes von Excel sowie Grundsätze in der Wirtschaftsprüfung. Im Vordergrund stand dabei der Einsatz von Notepad++, RapidMiner und Excel. Durch deren Anwendung konnte Studierende sich mit diesen Programmen vertraut machen und deren Vorteile identifizieren.

Die Studierenden empfanden die Ausarbeitungen der umfangreichen Fallstudien als fordernd und trugen nach deren Ansicht Fähigkeiten bei. Des Weiteren konnten diese durch den Einsatz der Programme Excel und RapidMiner ihr Wissen erweitern. Ein Wesentlicher Erfolgsfaktor, der für das Intensive Study Programm spricht, stellt die Zusammenarbeit auf internationaler Ebene dar. Neben dem Austausch in englischer Sprache, zeigt sich, dass Studierende durch unterschiedliche Vorgehensweisen und Gedankengänge in der gemeinsamen Bearbeitung von komplexen Problemstellungen durchwegs profitieren.

Bericht der Studierenden: erfahrungsbericht-dipcat-budapest-oktober-2021.pdf

FINALE BEURTEILUNG DER GUTACHTER

Nach Ablauf des Projektzeitraumes und Abhaltung der drei geplanten Intensive Study Programmes erfolgte die Beurteilung der Partnerschaft von Erasmus+ zu Bestnoten. Insgesamt sei das Projekt sehr gut durchgeführt geworden und habe gute Ergebnisse erzielt. Durch die Beschreibung der Projektziele der Entwicklung kognitiver, zwischenmenschlicher und praktischer Fähigkeiten für Absolventen des Rechnungswesens konnte die Relevanz klar dargestellt werden:

“Overall, this project was well delivered and achieved good results. The final report describes in a good way the relevance of the project by identifying the aims: develop cognitive skills, interpersonal skills, and practical skills for accountancy graduates.”

Außerdem wurde auch das gute Projektmanagement, eine klare Verwendung des Budgets sowie die gute Darstellung der Lehraktivitäten und der Teilnehmerprofile der Studierenden hervorgehoben.

“There is good information about the quality, effectiveness and efficiency of the project monitoring and evaluation. Budget control and time management are well described. The information provided about the learning/teaching/training activities and the participants’ profiles is well defined, and there’s clear information about the selection and evaluation of the activities.”

Auch von den teilnehmenden Studierenden gab es zur DIPCAT-Partnerschaft und den Intensive Study Programmes sehr positives Feedback. Die Fallstudien empfanden sie als sehr anspruchsvoll und fordernd und konnten dabei viel für ihr künftiges Berufsleben mitnehmen. Insbesondere der fachliche Schwerpunkt der Digitalisierung und die Verwendung diverser digitaler Tools wurde äußerst positiv gesehen.

Noch während des Projektzeitraums der DIPCAT-Partnerschaft hat der Großteil der Partneruniversitäten mit STAMP-online bereits die nächste Erasmus+ geförderte strategische Partnerschaft begonnen. Somit haben Studierende der Universität Innsbruck auch in den nächsten Jahren die Möglichkeit an internationalen Intensive Study Programmes teilzunehmen. Das nächste ISP im Rahmen von STAMP-online wird im Juli 2023 in Innsbruck stattfinden.

|

BOURNEMOUTH UNIVERSITY United Kingdom (Koordinator) UNIVERSITAET INNSBRUCK Austria FRIEDRICH-ALEXANDER-UNIVERSITAET ERLANGEN NUERNBERG Germany TECHNOLOGIKO EKPEDEFTIKO IDRIMA ANATOLIKIS MAKEDONIAS & THRAKIS Greece BUDAPESTI CORVINUS EGYETEM Hungary ISM VADYBOS IR EKONOMIKOS UNIVERSITETAS UAB Lithuania INSTITUTO POLITECNICO DO PORTO Portugal UNIVERSIDAD DE VIGO Spain UNIVERSITATEA DE VEST DIN TIMISOARA Romania Universita' degli Studi di Urbino Carlo Bo Italy UNIVERSITE DU LUXEMBOURG Luxembourg UNIVERSITE DE BRETAGNE SUD |

|

Univ.-Prof. Dr. Rudolf Steckel

Univ.-Ass. Dr. Sabine Graschitz

Univ.-Ass. Simona Holzknecht, MSc