Master’s Programme Accounting, Auditing and Taxation

Curriculum (2008W)

As of winter semester 2024/2025 this programme is no longer open to new entrants. For information on the succeeding master’s programme please consult this page »

Master of Science

Duration/ECTS-Credits

4 semesters/120 ECTS-Credits

Mode of Study

Full-time

Language

German

Requirements

Relevant bachelor's degree/equivalent and Language Certificates

Faculty

Faculty of Business and Management

Qualification Level

Master (Second Cycle)

ISCED-11: Level 7, EQF/NQF: Level 7

ISCED-F

0411 Accounting and Taxation

Study Code

UC 066 976

Application

It is recommended to commence the programme in the winter semester in order to avoid study delays.

The curriculum is the basis of a degree programme. A look at the curriculum for the Master Accounting, Auditing and Taxation gives you a detailed overview of the structure, content, examination regulations and qualification profile of this Master's degree.

The curriculum can clarify several important questions before you start your studies. For example, which criteria must be fulfilled for enrolment in the Master's Programme Accounting, Auditing and Taxation, how long the programme lasts, which modules must be completed and much more.

The 2008W curriculum currently applies to the Master's degree programme Accounting, Auditing and Taxation.

Information on the Curriculum (2008W)

The complete version of the curriculum reflects the currently valid version of the curriculum. It is for informational purposes only and is not legally binding. The legally binding version of the curriculum, including any amendments, may be found in the University of Innsbruck Bulletins.

In order to determine which version of the curriculum is applicable in your case, see the Catalogue of Studies,

available at: https://lfuonline.uibk.ac.at/public/lfuonline_meinestudien.studienblatt

Section: Current Curriculum version.

- English version of the Curriculum (from October 1 2022)

- University of Innsbruck Bulletin May 4 2022, Issue 40, No. 459

- English version of the Curriculum (from October 1 2019)

- University of Innsbruck Bulletin December 18, Issue 10, No. 140 (Equivalence list)

- University of Innsbruck Bulletin June 28 2019, Issue 65, No. 568 (modification of the curriculum)

- University of Innsbruck Bulletin February 13 2019, Issue 15, No. 264 (modification of the curriculum)

- University of Innsbruck Bulletin July 26 2018, Issue 60, No. 595 (Equivalence list)

- English version of the Curriculum (from October 1 2018)

- University of Innsbruck Bulletin February 15 2018, Issue 14, No. 201 (modification of the curriculum)

- English version of the Curriculum (from Ocotber 1 2014)

- University of Innsbruck Bulletin September 10 2014, Issue 46, No. 651 (Equivalence list)

- University of Innsbruck Bulletin June 18 2014, Issue 31, No. 508 (amendment of the curriculum)

- University of Innsbruck Bulletin June 2 2014, Issue 23, No. 391 (modification of the curriculum)

- University of Innsbruck Bulletin May 4 2007, Issue 51, No. 225

- English version of the Curriculum

Requirements

Relevant bachelor's resp. diploma degrees at the University of Innsbruck:

- Bachelor's Programme Economy, Health and Sports Tourism

- Bachelor's Programme Management and Economics

- Bachelor's Programme Sports Management

- Bachelor's Programme International Economic and Business Studies

Diploma Programme International Economic and Business Studies

Starting in academic year 2015/2016 qualitative admission requirements will be additionally reviewed:

Knowledge of accounting and the ability to solve problems in this area required for

understanding the content of this curriculum.

It is assumed that this knowledge has been attained, if a student has positively completed 15 ECTS credits in principles of financial and management accounting respectively from the areas of company taxation, controlling, management accounting, financial reporting or auditing.

Proof of general university entrance qualification:

The general university entrance qualification for admission to a master's programme must be proven by the completion of a subject-related bachelor's programme, another subject-related programme of at least the same higher education level at a recognised domestic or foreign post-secondary educational institution, or a program defined in the curriculum of the master's programme. To compensate for significant differences in subject matter, supplementary examinations (maximum 30 ECTS credits) may be prescribed, which must be taken by the end of the second semester of the master's programme. The rectorate may determine which of these supplementary examinations are prerequisites for taking examinations provided for in the curriculum of the master's programme.

In the course of the proof of the general university entrance qualification, the completion of the following core areas within the framework of the completed bachelor's degree programme shall be examined in any case:

- 100 ECTS-Credits Core Area: Economic Subjects, therefrom 50 ECTS-Credits Core Area: Business

Recommended Course Sequence

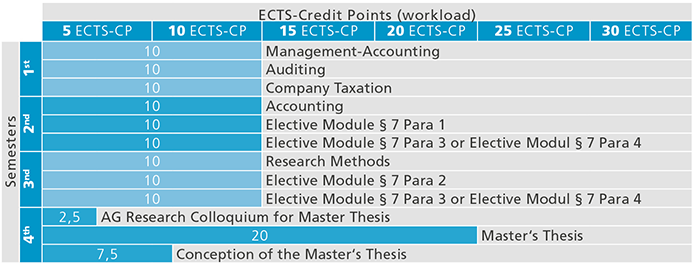

The exemplary course sequence given below is recommended for full-time students beginning their study programme in the winter semester. The table shows one possible course sequence for the bachelor's programme and is not compulsory. Delays resulting from repeated examinations are not taken into account.

The standard duration of the study programme is 4 semesters or 120 ECTS-Credits, whereby according to the Universities Act of 2002, a workload of 1,500 (real) hours per academic year must be fulfilled, corresponding to 60 ECTS-Credits (one ECTS-Credit is equivalent to a workload of 25 hours).

10.0 ECTS-Credits: Management-Accounting

10.0 ECTS-Credits: Auditing

10.0 ECTS-Credits: Company Taxation

10.0 ECTS-Credits: Accounting

10.0 ECTS-Credits: Elective Module § 7 Para 1

10.0 ECTS-Credits: Elective Module § 7 Para 3 or Elective Modul § 7 Para 4

10.0 ECTS-Credits: Research Methods

10.0 ECTS-Credits: Elective Module § 7 Para 2

10.0 ECTS-Credits: Elective Module § 7 Para 3 or Elective Modul § 7 Para 4

2.5 ECTS-Credits: AG Research Colloquium for Master Thesis

20.0 ECTS-Credits: Master's Thesis

7.5 ECTS-Credits: Conception of the Master's Thesis

10.0 ECTS-Credits: Management Control Across Industries

10.0 ECTS-Credits: Auditing according to International Standards on Auditing and Assurance Services

10.0 ECTS-Credits: Tax Planning

10.0 ECTS-Credits: Understanding and Designing Management

10.0 ECTS-Credits: Financial Reporting and Auditing

10.0 ECTS-Credits: Special Topics in Taxation

10.0 ECTS-Credits: Special Topics in International Accounting

10.0 ECTS-Credits: Interdisciplinary Perspectives on Accounting

10.0 ECTS-Credits: Current Topics in Management Control

10.0 ECTS-Credits: Case Studies in Management Control

10.0 ECTS-Credits: One module (not yet passed) out of the module according to § 7, Para. 1 an § 7, Para 2

10.0 ECTS-Credits: One module (not yet passed) out of the module according to § 7, Para. 1

10.0 ECTS-Credits: One module (not yet passed) out of the module according to § 7, Para. 2

5.0 ECTS-Credits: Corporate Valuation

5.0 ECTS-Credits: Information Economics

5.0 ECTS-Credits: Applied Risk Management

5.0 ECTS-Credits: Current Topics in Banking and Finance

5.0 ECTS-Credits: Financial Regulation

5.0 ECTS-Credits: Applied Behavioral Finance

10.0 ECTS-Credits: Current Topics of Information Systems, Especially Digital Society

10.0 ECTS-Credits: Ethics in Organizations

10.0 ECTS-Credits: Art, Culture, and Expert Organizations

10.0 ECTS-Credits: One module (not yet passed) out of the module according to § 8, Para. 1

10.0 ECTS-Credits: Gender, Work and Organization

10.0 ECTS-Credits: to be updated shortly

10.0 ECTS-Credits: Current Issues in Theory and Practice of Organizations

10.0 ECTS-Credits: Corporate Communication and Governance

10.0 ECTS-Credits: Entrepreneurship

10.0 ECTS-Credits: Marketing Performance Management

10.0 ECTS-Credits: Current Topics in Strategy and Marketing

10.0 ECTS-Credits: Creativity and Change Management

5.0 ECTS-Credits: Human Relation Management (I): Intercultural Human Resource Development

5.0 ECTS-Credits: Human Relation Management (II); Employment-Oriented Consulting

10.0 ECTS-Credits: Individual Focus Modules

| Semester | ECTS-AP | Titel |

|---|---|---|

Information about examination regulations, assessment and grading

Examination regulations

The examination regulation is an integral part of the curriculum, detailed information can be found under the paragraph examination regulations.

The grade distribution table is a statistical representation of the distribution of all successfully completed examinations in a given programme of study or subject (based on all registered students for the programme or subject). The grade distribution table is updated in regular intervals.

| Austrian grading scheme | Definition | %-age | ||

| 1 | EXCELLENT | 35.0 | = 100% | |

| 2 | GOOD | 44.4 | ||

| 3 | SATISFACTORY | 17.2 | ||

| 4 | SUFFICIENT | 3.4 | ||

| 5 | INSUFFICIENT |

March 2025

Overall classification of the qualification

Not applicable

Explanation: An overall classification (mit Auszeichnung bestanden/pass with distinction, bestanden/pass, nicht bestanden/fail) – is awarded only for examinations that conclude a programme of study and consist of more than one subject (an examination of this type is not specified in the curriculum of this programme of study).

Examination Dates (in German only)

13.02.2023 until 17.02.2023

Final exam registration: Monday, 30.01.2023 until 06.02.2023 12 a.m.

17.04.2023 until 21.04.2023

Final exam registration: Monday, 03.04.2023 until 10.04.2023 12 a.m.

22.05.2023 until 26.05.2023

Final exam registration: Monday, 08.05.2023 until 15.05.2023 12 a.m.

Subject to change for organisational reasons.

10.07.2023 until 14.07.2023

Final exam registration: Monday, 26.06.2023 until 03.07.2023 12 a.m.

11.09.2023 until 15.09.2023

Final exam registration: Monday, 28.08.2023 until 04.09.2023 12 a.m.

04.12.2023 until 07.12.2023

Final exam registration: Monday, 20.11.2023 until 27.11.2023 12 a.m.

Subject to change for organisational reasons.

Contact and Information

Examination Office

Standort Universitätsstraße 15

Associate Dean of Studies

Univ.-Prof. Mag. Dr. Silvia Jordan

Dean of Studies

Univ.-Prof. Mag. Dr. Mike Peters