Forschungsschwerpunktsystem

Die äußerst erfolgreiche Profilbildung an der Universität Innsbruck erfolgt seit mittlerweile mehr als zehn Jahren durch die wissenschaftliche Zusammenarbeit in Forschungsschwerpunkten, Forschungsplattformen und Forschungszentren.

Forschungsschwerpunkte und Forschungsplattformen sind interdisziplinär agierende Einheiten mit bis zu 60 Habilitierten, die in einem für die Universität Innsbruck charakteristischen Querschnittsthema gemeinsam forschen. In den kleineren Forschungszentren bearbeiten mehrere hochqualifizierte Wissenschaftler:innen ein gemeinsames Forschungsthema.

Auf einen Blick

Das Forschungsschwerpunktsystem besteht aktuell aus 8 Schwerpunkten, 1 Plattform, 39 Zentren und 20 Doktoratskollegs. Hier finden Sie einen Überblick.

Einrichtung und Evaluierung

Die formalen Kriterien zur Einrichtung und regelmäßigen Evaluierung der Forschungsschwerpunkte, -plattformen und -zentren sind in einem Leitfaden festgehalten.

Doktoratskollegs

Das zentrale Element der Doktoratskollegs ist die strukturierte Ausbildung von Dissertantinnen und Dissertanten auf höchstem wissenschaftlichem Niveau.

Forschungsschwerpunkte

Alpiner Raum

Mit dem FSP Alpiner Raum hat die Universität Innsbruck einen ihrer zentralen Schwerpunktbereiche räumlich definiert. Mit dieser Schwerpunktsetzung wird die langjährige Tradition und die weltweit bedeutende Rolle der Universität Innsbruck in der Gebirgsforschung fortgeführt.

Digital Science Center (DiSC)

Das Digital Science Center (DiSC) der Universität Innsbruck hat zum Ziel, die Digitalisierung der Forschung zu bündeln und voranzutreiben, um so neue Forschungsrichtungen einzuschlagen und die Qualität der Wissenschaft zu stärken.

Centrum für Molekulare Biowissenschaften (CMBI)

Das CMBI vereint Forscher:innen mehrerer naturwissenschaftlicher Disziplinen, einschließlich der Struktur- und Molekularbiologie, Chemie, Biophysik, Genetik, Molecular Modeling und den pharmazeutischen Wissenschaften auf international kompetitivem Niveau.

Functional Materials Science (FunMat)

Arbeitsgruppen aus vier Fakultäten arbeiten in diesem Forschungsschwerpunkt zusammen, um die Synergien zwischen Physik, Chemie, Erdwissenschaften, pharmazeutischer Technologie und Bauingenieurswesen zu nutzen.

Kulturelle Begegnungen - Kulturelle Konflikte

Der Forschungsschwerpunkt „Kulturelle Begegnungen – Kulturelle Konflikte“ ist ein Verbund geistes- und sozialwissenschaftlicher Fächer, der sich mit unterschiedlichen Formen kultureller Kontakte auseinandersetzt.

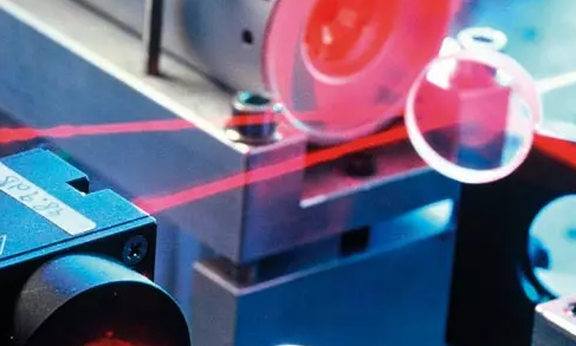

Physik

In einem sehr internationalen Umfeld verbindet der Forschungsschwerpunkt Physik Spitzenforschung auf einer breiten Palette von Gebieten der modernen Physik mit herausragenden Ausbildungsmöglichkeiten und vereint wesentliche Forschungsbereiche.

Scientific Computing

Der Forschungsschwerpunkt Scientific Computing integriert alle Forschungsaktivitäten in den Bereichen IT und computerunterstützter Forschung. Ziel ist es, bestehende Synergien innerhalb der Universität als auch mit anderen Universitäten und Institutionen in Österreich sowie weltweit zu nutzen.

Wirtschaft, Politik und Gesellschaft (EPoS)

EPoS „Economy, Politics & Society“ versteht sich als interdisziplinärer Schwerpunkt, in dem wirtschaftliche, organisationale, politische und gesellschaftliche Strukturen, Zusammenhänge und Entwicklungen erforscht werden.

Forschungsplattform

Center Interdisziplinäre Geschlechterforschung Innsbruck (CGI)

Die Forschungsplattform des Centers Interdisziplinäre Geschlechterforschung Innsbruck ist ein inter- und transdisziplinärer Verbund von Forschenden und Lehrenden im Feld der Frauen*-, Gender-, feministischen und Queer Forschung.

Forschungszentren und Doktoratskollegs

Alpiner Raum

Das Forschungszentrum "Alpine Infrastructure Engineering" ist Teil des Forschungsschwerpunkts "Alpiner Raum - Mensch und Umwelt" und fokussiert sich auf die zwei Themenbereiche "Infrastructure and Environment" und "Risk and Protection". Der Themenbereich "Infrastructure and Environment" stellt sich zum Ziel, technische und verkehrsplanerische Lösungen zum Verkehr im alpinen Raum zu entwickeln sowie innovative Verfahren für extreme Randbedingungen, Lösungen für die Ver- und Entsorgung von Siedlungen und Bauwerken, für die alpine Trinkwasserwirtschaft und den alpinen Wasserbau und die Wasserkraftnutzung auszuarbeiten.

Der Themenbereich „Risk and Protection“ untersucht Massenbewegungen (Geschiebe, Lawinen und Muren) und bauliche Schutzmaßnahmen, Entstehung und Auswirkung von Hochwasser, Hangrutschungen und Bergstürzen sowie die zugrundeliegenden Methoden der Wahrscheinlichkeit und Sicherheit. Website FZ Alpine Infrastructure Engineering

Das Forschungszentrum (FZ) „Alpinsport“ ist dem Forschungsschwerpunkt (FSP) „Alpiner Raum - Mensch und Umwelt“ (ARMU) zugeordnet. Die ForscherInnen des FZ „Alpinsport“ setzten sich mit den vielfältigen Aspekten des Alpinsportes auseinander. Neben den Auswirkungen alpinsportlicher Aktivität auf den gesunden und kranken menschlichen Organismus stehen auch die Entwicklung und die Optimierung von Trainingsmethoden und Ausrüstung im Zentrum wissenschaftlicher Forschung.

Die besondere Bedeutung des Alpinsports für Tirol und Österreich wird allein aus der Tatsache ersichtlich, dass alljährlich mehr als 10 Millionen Berg- und Skitouristen die heimischen Berggebiete aufsuchen; für den gesamten Alpenraum wird diese Zahl auf über 40 Millionen geschätzt. Ohne Zweifel kann Bergsport wesentlich zu den günstigen gesundheitlichen Auswirkungen körperlicher Aktivität beitragen, ist aber andererseits auch mit einem bestimmten Unfall- und Notfallrisiko verbunden. Daher sind die Forschungsbemühungen im FZ „Alpinsport“ vorrangig darauf ausgerichtet, dieses Risiko so weit wie möglich zu verringern und positive Effekte des Alpinsports gezielt herauszuarbeiten. Dies gilt für den Breitensport ebenso wie für den Spitzen- und Rehabilitationssport.

Das Forschungszentrum für Berglandwirtschaft bündelt die landwirtschaftliche Forschung an der Universität Innsbruck. Es bietet ein interdisziplinäres Forum für WissenschaftlerInnen verschiedenster Fachrichtungen, stimuliert Forschung zu landwirtschaftlichen Themen und fördert Kooperationen. Gemeinsam mit dem Land Tirol betreibt das Forschungszentrum Berglandwirtschaft den Forschungsbauernhof Imst der für Forschung und Lehre gemeinsam mit dem landwirtschaftlichen Versuchswesen des Landes Tirol genutzt wird. Das Forschungszentrum für Berglandwirtschaft fungiert zudem als Schnittstelle zwischen der Universität Innsbruck und außeruniversitären Einrichtungen. Mittels finanzieller Unterstützung des Landes Tirols unterstützt das Forschungszentrum Berglandwirtschaft in einem jährlichen „Call for Projects“ in einem kompetitiven Verfahren Forschungsprojekte zu landwirtschaftlichen Themen. Website FZ Berglandwirtschaft

Unser Forschungszentrum untersucht die Wechselwirkungen zwischen geogenen Stoffen und geodynamischen Prozessen und Umweltprozessen auf einer Vielzahl von räumlichen und zeitlichen Skalen sowie auf unterschiedlichen Druck- und Temperaturskalen. Wir untersuchen die chemischen und physikalischen Eigenschaften von Gesteinen, Mineralen und künstlichen gesteinsähnlichen Materialien und rekonstruieren Prozesse sowohl im Erdinneren als auch an der Erdoberfläche, die viele Millionen Jahre in die Vergangenheit reichen können. Geomaterialien steuern zum einen direkt geologische und geodynamische Prozesse und können zum anderen neben der Zeit auch Klima- und Umweltveränderungen aufzeichnen. Die Erforschung dieser geogenen Stoffe und Prozesse ermöglicht daher einzigartige Einblicke in die Erdgeschichte und die Bodenschätze unseres Planeten, und hat gesellschaftliche Relevanz.

Der Globale Wandel (Klimawandel, Globalisierung, soziokultureller Wandel, Ressourcenverknappung etc.) gewinnt sowohl in Gesellschaft und Politik als auch im wissenschaftlichen Diskurs an Bedeutung. Das Wechselspiel zwischen treibenden Kräften, Handlungen und Auswirkungen auf allen Maßstabsebenen (global bis lokal) ist zur zentralen Charakteristik des Anthropozäns geworden. Ziel des Forschungszentrums „Globaler Wandel – regionale Nachhaltigkeit“ ist einerseits das

Verständnis dieser Dynamik und ihrer Folgen für Mensch-Umwelt-Systeme. Andererseits wird der Frage nachgegangen, wie die Gesellschaft den Herausforderungen des 21. Jahrhunderts unter dem Leitbild der nachhaltigen Entwicklung begegnen kann.

Das Forschungszentrum schafft Raum für den interdisziplinären Dialog in der Global Change- und Nachhaltigkeitsforschung an der Schnittstelle zwischen Natur- und Gesellschaftswissenschaften. Theoretisch-konzeptionelle Arbeit, empirische sowie anwendungsorientierte Forschung und Umsetzung sind hier gleichbedeutend. Im Sinne einer zeitgemäßen, sich ihrer gesellschaftlichen Verantwortung bewussten Wissenschaft bringen sich die Mitglieder des Forschungszentrums aktiv in den transdisziplinären Dialog mit der Gesellschaft ein, um zu einer nachhaltigen Entwicklung beizutragen. Website FZ Globaler Wandel - regionale Nachhaltigkeit

Die östlichen Alpen sind historisch gesehen eine Fundgrube für Klimainformationen - und die Universität Innsbruck beherbergt ein weites Feld an Expertise in Atmosphären-, Kryosphären-Biosphären- Hydrosphären-Wissenschaften wie auch Atmosphärenchemie, Geomorphodynamik und Paläoklimatologie. Das Forschungszentrum Klima - Kryosphäre und Atmosphäre bringt diese Expertise durch interdisziplinäre Forschung an der Schnittstelle zwischen der Erdoberfläche und der Atmosphäre zusammen. Ein Schwerpunkt liegt dabei auf dem Austausch zwischen der Erdoberfläche und der Atmosphäre, sowie der Dynamik des Klimasystems im Gebirge über den gesamten Bereich von räumlichen und zeitlichen Skalen. Gebirge stellen aus der Sicht der Klimaforschung insbesondere durch die Komplexität der Topographie und dem daraus resultierenden (thermo)dynamischen Forcing der Atmosphäre eine besondere Herausforderung dar. Website FZ Klima - Kryosphäre und Atmosphäre

Zielsetzung des FZ „Ökologie des Alpinen Raumes“ ist es , hochwertige wissenschaftliche Erkenntnisse zur Ökologie von Gebirgslebensräumen zu liefern, aber auch die vielfältigen Interaktionen zwischen Mensch und Lebensraum sowie der kombinierten Auswirkungen von Landnutzung und Klimawandel zu analysieren. Die Spannbreite der untersuchten Ökosysteme und der darin enthaltenen Organismen und Populationen reicht von Gipfelregionen, über Gebirgsseen und -bäche, Gletschervorfeld und Waldgrenzökoton bis hin zu anthropogen genutzten Flächen. Unsere Forschungsflächen sind großteils in der LTSER (long-term socio-ecological research) platform Tyrolean Alps integriert. Vergleichende Forschungen wer-den zudem in arktischen Systemen, Anden und Himalaya durchgeführt. Methodisch kombinieren wir experimentelle Ansätze im Freiland und Labor mit räumlicher und zeitlicher Modellierung. Eine enge Vernetzung der am FZ beteiligten Forscher:innen soll zudem das Brückenschlagen zwischen den beteiligten Disziplinen erleichtern, echte interdisziplinäre Forschung fördern und damit zu einem deutlichen Mehrwert führen. Website Ökologie des Alpinen Raums

Das Forschungszentrum Tourismus & Freizeit ist ein Netzwerk und eine Plattform für alle Forscher:innen an der Universität Innsbruck. Das Zentrum entwickelt gemeinsame Projekte und bringt Forscher:innen von verschiedenste Fakultäten an der Universität Innsbruck zusammen um Tourismus- und Freizeitforschung voranzutreiben. Seit 2015 wurden bereits sieben Drittmittelprojekte abgeschlossen und weitere werden derzeit von Forscher:innen von sechs Fakultäten der Universität Innsbruck bearbeitet. Zudem werden zahlreiche Publikationen interdisziplinäre verfasst. Die Forschungsthemen umfassen bspw. Crowdfunding im Tourismus, den Einfluss des globalen Wandels (insbesondere Klimawandel) auf die Touristenbedürfnisse und Ressourcenausstattung der Destinationen, Sportevents- und Innovationen am Berg oder Familienunternehmensentwicklungen und Nachfolge im Tourismus. Das FZ Tourismus & Freizeit gründete kürzlich das neue Doktoratskolleg „Tourism and Leisure in Mountain Regions“. Website FZ Tourismus und Freizeit

Das „Doctoral Programme Alpine Biology and Global Change“ bietet ein Trainingsprogramm für verschiedene Disziplinen aus den Themenbereichen alpine Biologie und Globaler Wandel, das sich nach internationalen Qualitätsstandards orientiert. Das DP dient als einzigartige Plattform für den Austausch zwischen PhD Studierenden und PostDocs aus verschiedenen Disziplinen zur Unterstützung und Inspiration der jeweiligen Forschungsarbeiten. Website DK Alpine Biology and Global Change

Gebirge beeinflussen atmosphärische Strömungen und erzeugen starke Umweltgradienten in Raum und Zeit. Durch den Zusammenschluss von Expertinnen und Experten aus verschiedenen Disziplinen (Atmosphärendynamik und Chemie, Kryosphäre, Biosphäre, Hydrosphäre, Geomorphologie und Paleoklimatologie) sollen klimatische Prozesse sowie Klimavariabilität und Änderung in Vergangenheit und Zukunft (besser) identifiziert, verstanden und quantifiziert werden. Diese Daten wiederum sind eine wesentliche Grundlage für die Abschätzungen des Einflusses von klimatischen Veränderungen auf Gebirgsräume. Website DK Mountain Climate and Environment

Die Untersuchung von Naturgefahren in Gebirgsregionen beschäftigt und erfordert verschiedene Disziplinen. Im Doktoratskolleg Natural Hazards in Mountain Regions werden fächerübergreifend Fragestellungen, die neben der rein wissenschaftlichen Bedeutung oft hohe Relevanz für die Bevölkerung in Gebirgsregionen haben, bearbeitet. Besonders gefördert werden im Rahmen dieses Programmes PhD Studierende, die nicht nur fachlich mit angrenzenden Forschungsgebieten vernetzt werden, sondern auch verschiedene Synergien und Trainingsprogramme nutzen können. Insgesamt dient der intensive Austausch zwischen unterschiedlichen Fachrichtungen und Wissenschaftlern in unterschiedlichen Positionen auf der akademischen Laufbahn für alle Beteiligten zur Stärkung der gemeinsamen Forschungsaktivitäten und zur Steigerung der internationalen Sichtbarkeit. Website DK Natural Hazards in Mountain Regions

Das Doktoratskolleg für Tourism and Leisure in Mountain Regions hat sich zum Ziel gesetzt allen teilnehmenden PhD Studierenden eine exzellente Ausbildung in einem dynamischen und interdisziplinären Umfeld zu ermöglichen. Durch die Schaffung passender Rahmenbedingungen und der Möglichkeit in andere Disziplinen einzutauchen, können die Studierenden ihr Wissen erweitern und ihre Fachexpertise vertiefen. Außerdem erleichtert das Doktoratskolleg die Initiation, Entwicklung und Publikation qualitativ hochwertiger und innovativer Forschungsarbeiten. Basierend auf deren jeweiligen fachlichen Hintergrund haben Forschende – Phd Studierende, Postdocs und ProfessorInnen – die Möglichkeit interdisziplinäre Ansätze in deren Forschung zu forcieren und zu etablieren. Kommunikationsplattformen wie Workshops, Kanäle in den sozialen Medien und informelle Meetings, sowie Co-Working Plätze werden entwickelt um einen aktiven Wissensaustausch und gegenseitige Inspiration zu fördern. Website DK Tourism and Leisure in Mountain Regions

Centrum für Molekulare Biowissenschaften Innsbruck (CMBI)

Das Doktoratskolleg Ageing and Regeneration (AGE_REG) wurde im Rahmen des Forschungsschwerpunkts Center for Molecular Biosciences Innsbruck (CMBI) an der Universität Innsbruck im Jahr 2016 gegründet. Das wichtigste Ziel ist es, exzellenten Nachwuchswissenschaftler:innen aus dem In- und Ausland eine Plattform zur postgradualen Ausbildung auf höchstem Niveau in Verbindung mit Spitzenforschung zu aktuellen Themen der Life Sciences zu bieten. Durch den Zusammenschluss von hochqualifizierten Wissenschaftler:innen aus unterschiedlichen Fachbereichen wird ein ausgezeichnetes Umfeld geschaffen, in dem die DK Nachwuchswissenschaftler:innen in den Forschungsbetrieb auf internationalem Niveau und in die Scientific Community eingebunden werden. Die Dissertant:innen erhalten die Möglichkeit einer fächerübergreifenden Zusammenarbeit bei der Entwicklung neuer experimenteller Ansätze zu Fragen der Alterung und Regeneration, sowie bei anwendungsbezogener Forschung in den Studienrichtungen Molekular- und Zellbiologie, Alternsforschung, Regenerationsforschung, und Regenerative Medizin. Die NachwuchswissenschaftlerInnen können ihre Forschungsergebnisse international publizieren und vor der internationalen Scientific Community im Rahmen von Tagungen präsentieren. Website DK Ageing and Regeneration

DP ARDRE is a interdisciplinary EC H2020 Marie Skłodowska-Curie COFUND doctoral training programme for international high-potential early-stage researchers (ESRs) with a focus on ageing research, research in stem cells and regeneration, as well as drug research at the University of Innsbruck (UIBK) in Austria.

DP ARDRE provides training for 12 highly qualified ESR fellows, who wish to obtain a doctoral degree in one of the programme's research areas in biology, chemistry and pharmacy. All ARDRE PhD students are provided with the possibilities and encouragement to assume secondments (between a few weeks and several months) to international academic and intersectoral industrial partner organisations. Website DK Ageing, Regeneration, and Drug Research (DP ARDRE)

Digital Science Center (DiSC)

Die Geisteswissenschaften bleiben von dem Paradigmenwechsel, ausgelöst durch die digitale Revolution, nicht unberührt. Die Digital Humanities (DH) setzen sich zum Ziel, den Einsatz der Informationstechnologien in den Kultur- und Geisteswissenschaften zu erforschen und ihn voranzutreiben. Dabei adaptieren sie nicht bloß bestehende Methoden für die neue Arbeitsumgebung, sondern entwickeln auch neue Forschungsstrategien und -ansätze. Gleichzeitig lassen DH bei der Fokussierung auf die digitalen Methoden auch die Folgen des „digital turns“ sowohl für die Gesellschaft als auch für die Kultur- und Geisteswissenschaften nicht aus den Augen. Website FZ Digital Humanities

Functional Materials Science (FunMat)

Ziel des Doktoratskollegs ist die postgraduale Ausbildung qualifizierter Studierender aus dem In- und Ausland auf Exzellenzniveau zu aktuellen und relevanten Fragestellungen der Reaktivität und Katalyse auf dem Gebiet der Material- und Nanowissenschaften. Der Zusammenschluss von drei Fakultäten (Chemie und Pharmazie, Geo- und Atmosphärenwissenschaften, sowie Mathematik, Informatik und Physik) und fünf Instituten erlaubt den Studierenden im Rahmen des Doktoratskollegs unterschiedliche Blickwinkel auf verschiedene Aspekte der Reaktivität: homogene und heterogene Katalyse, Reaktivität an/von Oberflächen und Grenzflächen, Aktivierungsmechanismen von Molekülen, sowie von Biomolekülen, Reaktivität von Metallen, intermetallischen Phasen, Oxiden, Metall-Oxid Systemen und Gasphasenmolekülen. Website DK Reaktivität und Katalyse

Kulturelle Begegnungen - Kulturelle Konflikte

Das Forschungszentrum Ancient Worlds Studies and Archaeologies (AWOSA) verfolgt zielgerichtet eine Intensivierung und Internationalisierung der interdisziplinären Zusammenarbeit und des Austausches der historischen, philologischen und archäologischen Fächer nicht nur untereinander, sondern dezidiert auch mit anderen Disziplinen wie Naturwissenschaften (Chemie, Biologie, Geologie etc.) und sozio- und kulturwissenschaftlichen Fächern wie Zeitgeschichte, Orientalistik, Ethnologie etc., mit dem Ziel, aktuelle Fragestellungen und Probleme ansprechen und adäquate Methoden und Lösungsvorschläge (sowie ganz konkret Forschungsvorhaben bzw. -projekte) entwickeln und durchführen zu können. Website FZ Ancient Worlds Studies and Archaeologies (AWOSA)

Die Geisteswissenschaften bleiben von dem Paradigmenwechsel, ausgelöst durch die digitale Revolution, nicht unberührt. Die Digital Humanities (DH) setzen sich zum Ziel, den Einsatz der Informationstechnologien in den Kultur- und Geisteswissenschaften zu erforschen und ihn voranzutreiben. Dabei adaptieren sie nicht bloß bestehende Methoden für die neue Arbeitsumgebung, sondern entwickeln auch neue Forschungsstrategien und -ansätze. Gleichzeitig lassen DH bei der Fokussierung auf die digitalen Methoden auch die Folgen des „digital turns“ sowohl für die Gesellschaft als auch für die Kultur- und Geisteswissenschaften nicht aus den Augen. Website FZ Digital Humanities

Das Forschungszentrum „Europakonzeptionen“ will zu einer wissenschaftlichen Aufklärung über langfristig entstandene und bis heute wirksame Vorstellungen und Wahrnehmungen von Europa beitragen. Sowohl innerhalb als auch außerhalb Europas entstanden Bilder des Kontinents und soziale Praktiken seiner Lebenswelten, die zur Wirklichkeit von Politik, Ökonomie, Lebensalltag und Mentalitäten europäischer Gesellschaften gehörten und gehören. Wahrnehmungen inner- und außereuropäischer Beobachter, Praktiken der sozialen Ordnung des europäischen Raumes, transnationale Netzwerke und Kommunikationsformen sowie Entwürfe unterschiedlicher Akteure zu dem, was Europa ist oder sein sollte, prägten die Sichtweisen und Perspektiven auf den Kontinent. Website FZ Europakonzeptionen

Bereits die Errichtung des MA Program for Peace, Development, Security and International Conflict Transformation an der LFU im Jahr 2001 war von der Idee getragen, den Standort Innsbruck einerseits in die global bestehende Szene des Faches einzubinden, andererseits ein Profil zu entwickeln, das sich vom Bestehendem unterscheidet. Insbesondere zu den Ansätzen und Zentren im deutschen Sprachraum sollte keine Konkurrenz, sondern Alternative und Ergänzung erzeugt werden.

Zu diesem Zweck wurde der damals friedensphilosophisch neue Ansatz der „vielen Frieden“ aufgegriffen, zum curricularen und didaktischen Prinzip erhoben und mit Nachdruck weiter erforscht. Daraus entstand im Laufe der Jahre der Schlüsselbegriff transrationale Friedensforschung, der mittlerweile als Innsbrucker Schule oder Innsbrucker Ansatz des Fachs internationale Anerkennung gefunden hat. 2008 wurde dieses Bemühen mit der Errichtung eines eigenen UNESCO Lehrstuhls für Friedensforschung an der Universität Innsbruck belohnt. Website FZ Friedens- und Konfliktforschung

Die Felder, Theorien, Methoden und Begriffe, in denen und mit denen Phänomene des Kontaktes, des Austauschs und des Konflikts zwischen Menschen und sozialen Gruppen beschrieben und konstruiert werden, sind vielfältig. Entsprechend divers sind die Perspektiven und Themenfelder unserer interdisziplinären Forscher:innengruppe, welche diese Vielfalt aus unterschiedlichen Perspektiven betrachtet, analysiert und in Austausch bringt. Website FZ Kulturen in Kontakt (KiK)

Migration im globalen Maßstab ist ein Schlüsselthema zum Verständnis der Gegenwart, die plurale Migrationsgesellschaft Realität – auch in Österreich. Die Gesellschaften als Ganzes sind durch Migration in ihren verschiedenen Formen und deren Folgen tiefgreifenden Veränderungen unterworfen, kein Bereich bleibt davon unberührt. Website FZ Migration und Globalisierung

Tiroler Landesgeschichte – verstanden als eine Regionalgeschichte, die Forschungsfragen in der Region verfolgt, sie aber in kontinuierlichem Abgleich mit den größeren Räumen und Diskursen stellt – soll der zentrale Inhalt des interdisziplinären Forschungszentrums „Regionalgeschichte Europaregion Tirol“ sein. Dabei soll sich das Verständnis der Landesgeschichte, konkret des Bundeslandes Tirol, Südtirols und des Trentinos (Autonome Region Trentino-Alto Adige/Südtirol) sowie der heute außerhalb davon befindlichen Gebiete Cortina d’Ampezzo und Buchenstein, in ihrer ganzen Breite und zeitlichen Erstreckung als Teil einer modernen Regionalgeschichte etablieren. Website FZ Regionalgeschichte Europaregion Tirol

Das Forschungszentrum untersucht die Bedeutung der biblischen Offenbarung und kirchlichen Praxis bezüglich der Problematik von Religion, Kommunikation und Gewalt in der Gegenwart. Unsere Arbeit möchte auf kulturelle Wandlungen in Richtung friedvollerer Beziehungen hinarbeiten. Als vorrangiger Praxisort gilt die Kirche in ihrer gemeindlichen und weltkirchlichen Verfasstheit, vor allem in ihrem Dialog mit anderen Religionen und Weltanschauungen in einer pluralen Gesellschaft. Weil sich unsere Kirche im Zweiten Vatikanischen Konzil verpflichtet hat, sich so zu erneuern, dass sie immer deutlicher als ein Zeichen für mögliches Heil in einer globalen und von tiefen Konflikten geprägten Welt gesehen werden kann, stehen wichtige Fragen auch im Blick auf ihre inneren und äußeren Kommunikationsformen auf der Tagesordnung. Website FZ Religion - Gewalt - Kommunikation - Weltordnung

Das Forschungszentrum „Synagoge und Kirchen“ versteht sich als Schnittstelle von Grundlagenforschung und Praxisanwendung bezüglich des Verhältnisses von Christentum und Judentum wie auch jenem der christlichen Kirchen und Theologien untereinander. Da diese Verhältnisse in Geschichte und Gegenwart zutiefst kulturelle Begegnungen und Abgrenzungen darstellen, sind wir seit Sommer 2014 auch Teil des Forschungsschwerpunktes „Kulturelle Begegnungen – kulturelle Konflikte“. In den regelmäßigen Forschungsgesprächen beschäftigen wir uns seit 2017 mit Aspekten religiöser Autorität (heilige Schriften, personal ausgeübte Ämter, kollektiv handelnde Institutionen, Autorität jenseits institutionalisierter Strukturen) in Judentum, Christentum und Islam. Die Forschungen werden jährlich in einer Buchpublikation gebündelt werden. Seit Herbst 2021 befassen wir uns mit dem Thema "Machtstrukturen". Website FZ Synagoge und Kirchen

Ein Doktoratskolleg für Österreich-Studien (mit der mittelfristigen Perspektive eines gleichnamigen Zentrums) will zunächst eine universitätsinterne interdisziplinäre Plattform der Zusammenarbeit bereitstellen, als Basis gemeinsamer Lehre und Forschung. Als zentrale Kriterien für die Kooperationen entscheidend sind hier vorerst der davon berührte Raum, seine Geschichte und die kulturellen Phänomene. Insofern wird das im Titel genannte ‚Austrian‘ als von unterschiedlichen Gesellschaften produzierter ,Kulturraum’ entlang der Zeitachse von Heiligen Römischen Reich, über die Habsburgermonarchie bis in die unmittelbare Gegenwart der Zweiten Republik verstanden. Website DK Austrian Studies

Das Doktoratskolleg Catholic Theology in a Globalised World (DKTh) stellt maßgebliche Entwicklungen in Kirche und Weltgesellschaft ins Zentrum seiner Aufmerksamkeit, um zu einer Theologie beizutragen, die einer Kirche - die in vielen Herausforderungen und Konflikten steht -, dazu verhelfen möchte, ihre globale Verantwortung angemessener nach innen und nach außen wahrzunehmen. Als ältester und größter globaler Player wohl nicht nur der europäischen Geschichte kann die Katholische Kirche für eine Weltgesellschaft, die in einem ebenso radikalen Wandel wie in einer tiefen Krise steckt, einen hilfreichen und nachhaltigen Beitrag leisten. Website DK Catholic Theology in a Globalised World

Ungleichheit und Differenz sind soziale Tatsachen in allen Gesellschaften, sie prägen das Zusammenleben jedoch in unterschiedlichem Ausmaß. Ungleichheit und Differenz sind das Ergebnis sozialer Aushandlungsprozesse, in denen Zugang zu und Verfügungsrechte über materielle und immaterielle Ressourcen verteilt werden. Dabei verschränken sich vertikale und horizontale Disparitäten miteinander: Vertikale Ungleichheit umfasst ökonomische Unterschiede bei Einkommen und Vermögen und einen variierenden Zugang zu Produktionsmitteln, Arbeitsmarkt, Kapital, Kredit und Leistungen des Sozialstaats (z.B. Bildung und Gesundheit). Zu Differenz als einer horizontalen Disparität zählen die unterschiedlichen Möglichkeiten gesellschaftlicher Zugehörigkeit und sozialer Teilhabe, die sich aus Nationalität, Geschlecht, Hautfarbe, Religion, Alter oder Sprache ergeben. Beide Formen überlagern, verstärken (und schwächen) sich jedoch intersektional in den Achsen globaler Exklusions- und Inklusionsmechanismen wie Rassismus, Linguizismus, Geschlechter- und Klassenverhältnissen, die sich in entsprechenden regionalen Prozessen spiegeln. Website DK Dynamiken von Ungleichheit und Differenz im Zeitalter der Globalisierung

Das Doktoratskolleg „Entangled Antiquities“ beschäftigt sich mit der Verflechtung antiker Lebensräume (1500 v. Chr. bis 1500 n. Chr.) in der afro-eurasischen Welt, mitunter von Spanien bis nach China. Untersuchungsgegenstand ist die megaräumliche Konnektivität von protoglobalen Imperien mit lokalen politischen Gebilden. Ein besonderer Fokus liegt auf den Wechselwirkungen, die sie aufeinander ausüben sowie den lokalen Agenden, also der Aneignung, Transformation und Resilienz der Lokalen gegenüber kosmopolitischen Gütern und Errungenschaften im Kontext transregionaler Globalisierungsprozesse. Durch transdisziplinäre Zugänge und Methoden wird versucht, die traditionell isolierten Fächer der Philologien, Archäologien und Geschichtswissenschaften zusammenzuführen, um das eurozentrische Weltbild abgesonderter Kulturräume zu hinterfragen und in einem globalhistorischen Rahmen neu zu untersuchen. Website DK Entangled Antiquities

Konzepte der Festschreibung, Verschiebung und Überschreitung von Grenzen (Liminalität Variabilität und Transgressivität) konstituieren und strukturieren wesentlich den Gegenstandsbereich der Sprach-, Literatur- und Kulturwissenschaften mit. Im geplanten Doktoratskolleg sollen sie sowohl in ihrer kategorialen Verwendung als auch in ihren je unterschiedlichen sprachlichen, kulturellen und medialen Praktiken untersucht werden. Dafür werden verschiedene Arbeitsfelder, die bereits an der Philologisch-Kulturwissenschaftlichen Fakultät der Universität Innsbruck etabliert sind, unter systematischen Aspekten zusammengeführt. Website DK Grenzen, Grenzverschiebungen und Grenzüberschreitungen in Sprache, Literatur, Medien

Physik

Die hochaktuellen Forschungsbereiche der Astro- und Teilchenphysik befinden sich weltweit in einer stürmischen Entwicklung und sind Gegenstand zahlreicher internationaler Großprojekte. Zugleich rücken diese Arbeitsgebiete inhaltlich und methodisch weltweit immer näher zusammen, wobei der neue Forschungszweig der Astroteilchenphysik etabliert wurde. Mit der Bildung des Zentrums wurde dieser internationalen Entwicklung gefolgt, um mit möglichst vielen Synergieeffekten auf diesen Forschungsgebieten arbeiten zu können.

Im Forschungszentrum Ionen- und Plasmaphysik / Angewandte Physik werden sowohl grundlegende Phänomene aus den Bereichen Atom-, Molekül- und Plasmaphysik untersucht als auch Anwendungen dieser Ergebnisse in Bereiche wie Material-, Fusions-, Energie-, Umwelt- und Biophysik bis hin zur Medizintechnik erforscht und entwickelt.

Die anwendungsorientierten Perspektiven der o. a. Teilgebiete führten zur Gründung von über 10 meist sehr erfolgreichen Hightech-Betrieben in Tirol durch Mitarbeiter und ehemalige Studenten dieses Zentrums. Über 1000 Arbeitsplätze wurden durch diese Firmen geschaffen, die es ausgebildeten Physikern maßgeblich ermöglichen ihren Beruf in Tirol auszuüben. In den Jahren 2015 bis 2017 wurden 243 Beiträge in referierten Fachzeitschriften veröffentlicht, 12 Dissertationen und 14 Master-/Diplomarbeiten zum Abschluss gebracht und neun internationale Konferenzen mit teilweise über 100 Teilnehmer:innen organisiert. Website FZ Ionen- und Plasmaphysik/Angewandte Physik

Das Forschungszentrum für Quantenphysik umfasst diverse Forschungsaktivitäten im Bereich der modernen Quantenphysik, die von den Grundlagen bis hin zu den Anwendungen reichen. Eines der zentralen Ziele der Arbeiten ist die Realisierung von Quantencomputern bzw. von Quantensimulatoren. Unterstützt von zahlreichen theoretischen Aktivitäten werden Vielteilchen-Quantensysteme, die aus lasergekühlten Ionen, neutralen Atomen und Molekülen oder supraleitenden Schaltkreisen bestehen, als mögliche Plattformen des Quantencomputers bzw. des Quantensimulators experimentell untersucht. Damit verbunden ist die Entwicklung von Quantenschnittstellen, um Quanteninformation zwischen unterschiedlichen Plattformen austauschen zu können.

The Doctoral Programme (Doktoratskolleg) Atoms, Light, and Molecules, DK-ALM, is a collaborative programme that provides a research and training environment for excellent national and international students.

It is funded by the Austrian Science Fund (FWF) and started in January 2016. The programme combines fore-front research in several scientific fields within the framework of atomic, molecular and optical physics with high-level education.

The doctoral programme is linked to the four Physics Institutes at the University of Innsbruck and to the Physics Research Center, one of the five Research Focal Points of the University. Website DK Atome, Licht und Moleküle (DK-ALM)

Scientific Computing

Im Forschungszentrum Computational Engineering sind jene Forschungsaktivitäten zusammengefasst, die zur Lösung anspruchsvoller Aufgaben der Ingenieurwissenschaften durch die wissenschaftlich fundierte Weiterentwicklung von computergestützten Planungs- und Analysemethoden beitragen. Website FZ Computational Engineering

High Performance Computing (HPC) hat sich in den letzten 10 Jahren zweifelsohne zu einer Schlüsseltechnologie für Wissenschaft, Industrie und Wirtschaft entwickelt. Laufend entstehen neue Anwendungen, die von einer effektiven Parallelisierung profitieren. Hochleistungsrechnen ist eine treibende Kraft bei der Entwicklung neuer Formen der Medizin, bei der Suche nach erneuerbaren und sauberen Energiequellen, bei der Umsetzung effizienter und intelligenter Verkehrssysteme, bei der Klimamodellierung sowie Vorhersage und Bewältigung von Naturkatastrophen, bei der Optimierung der Lebensmittelerzeugung als Teil einer nachhaltigeren Landwirtschaft, beim Aufbau von wirksamen Sicherheitskonzepten im Umgang mit IT Infrastrukturen, u.v.a. Ein weiteres Wachstum von HPC in Breite und Tiefe ist zu erwarten und für eine konkurrenzfähige Forschung und Entwicklung im Sinne von „to out-compute will be to out-compete“ unverzichtbar. Website FZ Hochleistungsrechnen

Die Informatik durchdringt inzwischen nahezu alle Wissenschaftsdisziplinen, Industrie-zweige und Lebensbereiche. In diesem Kontext spielt das Zentrum Informatik eine wichtige Rolle, sowohl für die Weiterentwicklung informatikspezifischer Forschungsthemen im internationalen Kontext, als auch für Kooperationen innerhalb und außerhalb der Universität. Unsere Zielsetzung kann wie folgt charakterisiert werden:

- Arbeit an wissenschaftlichen Themen in einem anwendungsorientierten Kontext

- Entwicklung fundierter Konzepte, Methoden und Werkzeuge für nachhaltige Resultate

- Transfer und Weiterentwicklung unserer Ideen in praktischen Anwendungen und Kooperationen

Das Doktoratskolleg Computational Interdisciplinary Modelling (DK CIM) wurde im Rahmen des Forschungsschwerpunkts Scientific Computing an der Universität Innsbruck 2010 gegründet. Das wichtigste Ziel ist es, exzellenten Nachwuchswissenschaftler:innen aus dem In- und Ausland eine Plattform zur postgradualen Ausbildung auf höchstem Niveau in Verbindung mit Spitzenforschung zu aktuellen Themen der Naturwissenschaften und Technischen Wissenschaften zu bieten. Durch den Zusammenschluss von hochqualifizierten Wissenschaftlern:innen aus unterschiedlichen Fachbereichen wird ein ausgezeichnetes Umfeld geschaffen, in dem die DK Nachwuchswissenschaftler:innen in den Forschungsbetrieb auf internationalem Niveau und die Scientific Community eingebunden werden. Die Dissertant:innen erhalten die Möglichkeit der engen fächerübergreifenden Zusammenarbeit bei der Entwicklung neuer Methoden der rechnergestützten Modellierung, sowie bei anwendungsbezogener Forschung in den Studienrichtungen Atmosphärenwissenschaften, Chemie, (Biomedizinische) Informatik, Mathematik, Physik und Technischen Wissenschaften. Die Nachwuchswissenschaftler:innen können ihre Forschungsergebnisse international publizieren und vor der internationalen Scientific Community im Rahmen von Tagungen präsentieren. Website DK Computational Interdisciplinary Modelling

Bei dem Doktoratsprogramm DOCC handelt es sich um ein interdisziplinäres EC H2020 Marie Skłodowska-Curie COFUND Ausbildungsprogramm für vielversprechende Nachwuchsforscher:innen mit Fokus auf Modellierung und Simulation in der naturwissenschaftlicher Grundlagenforschung wie auch in den Ingenieurswissenschaften an der Universität Innsbruck in Österreich. Website DOCC: Dynamics of Complex Continua

Wirtschaft, Politik & Gesellschaft (EPoS)

Das Forschungszentrum Accounting Theory & Research erforscht die Rolle und Bedeutung von Accounting in Unternehmen, Organisationen und der Gesellschaft. In einer interdisziplinären sozialwissenschaftlichen Perspektive verstehen wir unter Accounting Formen quantifizierender und kalkulativer Praktiken. Während Accountingpraktiken, wie etwa das externe und interne Rechnungswesen, Risikomanagement, Steuermanagement oder integrierte Berichterstattung ursprünglich im Kontext von und für Unternehmen entwickelt wurden, haben sie sich heute in das Feld der Nonprofit-Organisationen sowie in weitere Bereiche der Gesellschaft ausgebreitet. Website FZ Accounting Theory & Research

Das FZ BGL ist mehrdimensional angelegt: Im Spannungsfeld zwischen sozialem Wandel in Gegenwartsgesellschaften und Bildungspolitik und in Ausrichtung auf das gesamte Spektrum zwischen sozialer Inklusion und Interkulturalität als Prinzip richtet sich das Gesamtinteresse auf den Kontext des lebenslangen und lebensumfassenden Lernens unter Berücksichtigung des gesamten Spektrums zwischen formalem, nicht-formalem und informellem Lernen. Website FZ Bildung, Generation, Lebenslauf (BGL)

Das Forschungszentrum Innsbruck Decision Sciences (IDS) beschäftigt sich mit der Erforschung menschlichen Verhaltens in ökonomisch relevanten Entscheidungssituationen, insbesondere auch im Kontext der Digitalisierung. Das Spektrum reicht dabei von alltäglichen Konsumentscheidungen, über grundlegende Fragen zu Präferenzen und individuelle Eigenschaften, die Entscheidungen leiten, bis hin zu Entscheidungen mit langfristigen Konsequenzen wie der Wahl der Altersvorsorge, finanzielle Anlageentscheidungen oder der Entscheidung zu einem nachhaltigen Lebensstil. Dabei wird ein besonderer Fokus auf den Einsatz von digitalen Technologien und ihrer Rolle bei der Unterstützung und Verbesserung der Entscheidungsfindung gelegt. Website FZ Innsbruck Decision Sciences (IDS)

Ziel des FZ Social Theory ist es, die Theoriearbeit selbst in den Mittelpunkt der Zusammenarbeit zu stellen und die metatheoretische, epistemologische Reflexion und Diskussion unter den Mitgliedern zu fördern.

Traditionen der epistemischen Reflexion und theoretische Grundlagenforschung werden in jedem Fachgebiet kultiviert, aber es ist ein besonderes Anliegen der Sozial- und Geisteswissenschaften, dass sie ihre theoretischen Grundlagen immer wieder aufs Neue lehren, befragen, einsetzen und weiterentwickeln und multiparadigmatisch arbeiten. Das FZ Social Theory blickt auf die Gesamtheit sozialwissenschaftlicher Theorien und beschäftigt sich mit diesen aus historisch-wissenssoziologischer, erkenntnistheoretischer und sozialphilosophischer Perspektive. Es fördert den offenen Austausch zwischen theoretischen Schulen und Ansätzen. Website FZ Social Theory

Innovationkraft und die Differenzierung vom Wettbewerb durch attraktive Marken sind entscheidend für den nachhaltigen Erfolg von Organisationen aller Art und damit auch Voraussetzung für den Erhalt des gesellschaftlichen Wohlstandes. Technologische Entwicklungen, digitale Transformation und soziale Medien haben neue Geschäftsmodelle hervorgebracht und verändern Unternehmertum und das Verhalten von Konsumenten gleichermaßen. Agile Unternehmen, nachhaltige Innovationen sowie die Entwicklung und Führung starker Marken sind gleichermaßen wichtig, um den neuen Herausforderungen und Entwicklungen nachhaltig zu begegnen. Entsprechende Führungssysteme, Ressourcenentwicklung und Marktinformationen bilden eine wichtige Grundlage für erfolgreiches Unternehmertum. Das Wissen über Konsumenten und Stakeholder bildet eine weitere tragende Säule für nachhaltigen Unternehmenserfolg und resiliente Organisationen. Beide Säulen werden damit zur treibenden und gleichzeitig koordinierenden Kraft für Innovation und Marke. Deshalb beschäftigt sich das Forschungszentrum mit grundlegen-den Fragen des Verhaltens von Konsumenten und Stakeholdern sowie des nachhaltigen Wirtschaftens und der Führung von Organisationen auf Basis von Innovation und der Führung von Unternehmen und Marken. Website FZ Strategische Führung, Innovation und Marke

Das Doktoratsprogramm #OrganizingtheDigital: Relations, Publics, Societies fördert die transdisziplinäre Forschung, welche die Verknüpfung und Überschreitung der Analyse digitaler Phänomene auf der Mikro-, Meso- und Makroebene vorantreibt. Mithilfe eines multi-methodischen und interdisziplinären Ansatzes soll zur Erweiterung der experimentell-, qualitativ- und interpretativorientierten konzeptuellen Forschung, deren Quantifizierung und von Netzwerkanalysen beigetragen werden.

Das Doktoratsprogramm und dessen Mitglieder verpflichten sich den internationalen Standards der Exzellenz in der Wissenschaft. Die am Doktoratsprogramm teilnehmenden Studierenden erwerben die notwendigen intellektuellen und praktischen Fähigkeiten um diese Standards zu erfüllen und in führenden wissenschaftlichen Journals publizieren zu können. Website DK Organizing the Digital

Politik, Macht und Sprache sind drei Begriffe, die heute stark umstritten sind, und damit auch ihr Verhältnis zueinander. Politik, Macht und Sprache und ihre Verflechtungen sind der Kern des Doktorandenkollegs Politik, Macht und Sprache (DC Politics, Power and Language), das diese drei Konzepte durch den Austausch zwischen verschiedenen Disziplinen innerhalb und außerhalb der Sozial- und Geisteswissenschaften (z.B. Informatik, Digital Humanities, Ökonomie, Gender Studies, Geschichte, Linguistik, Medien und Kommunikation, Philosophie, Politikwissenschaft, Soziologie) behandelt. Website DK Politik, Macht und Sprache

Nähere Informationen folgen...

Center Interdisziplinäre Geschlechterforschung Innsbruck (CGI)

Das Forschungszentrum Medical Humanities ist ein inter- und transdisziplinärer Zusammenschluss von Wissenschaftler:innen der Universität Innsbruck, die sich in ihren Forschungen aus geistes-, sozial-, sprach-, bildungs- und kulturwissenschaftlichen Perspektiven unter geschlechterkritischer Herangehensweise mit Themen und Konzepten der medizinischen Wissenschaften befassen. Die teilnehmenden Forscher:innen widmen sich u. a. den Zusammenhängen zwischen Gesundheit und Gesellschaft, Fragen von Gesundheit und Umwelt und dem Thema der Gesundheit als Ressource. Sie befassen sich in diesem Zusammenhang mit Biopolitik, Bioethik und Reproduktionstechnologien sowie mit Gesundheits- und Sozialpolitik. Weitere Schwerpunkte bilden Forschungen zur Philosophie der Medizin, zu Fragen der Gesundheitskommunikation, zu Körperlichkeit und Körperbildern, zu Geschlechterkonzepten, Ability und DisAbility sowie Care-Ordnungen und Care-Konstellationen in Geschichte und Gegenwart. Website FZ Medical Humanities

Das Doktoratskolleg widmet sich der Untersuchung der Transformation von Geschlecht und Geschlechterverhältnissen in ihren historischen, räumlichen und wechselseitigen Beziehungen, Bedingungen und Wirkungen. Es fokussiert auf die Analyse von Wandlungsprozessen, von Veränderungs- und Beharrungsregimen einschließlich der sozialen Kämpfe und zivilgesellschaftlichen Protestkonstellationen, durch die diese angestoßen, behindert, mobilisiert und moderiert werden. Notwendig für diese Forschungsunternehmung ist eine interdisziplinäre, intersektionale und transnationale/ transregionale Analyseperspektive. Website DK Geschlecht und Geschlechterverhältnisse in Transformation: Räume - Relationen - Repräsentationen

Forschungszentren und Doktoratskollegs ohne Affiliation

Das Center for European Integration Innsbruck (CEI) versucht in seiner Eigenschaft als Forschungszentrum der Rechtswissenschaftlichen Fakultät der Universität Innsbruck zunächst aus Sicht der gesamten Rechtswissenschaft, aber auch in Kooperation mit Nachbarwissenschaften wie den Politik-, Wirtschafts- und Sozialwissenschaften das Phänomen regionaler Integration zu erfassen und wissenschaftlich aufzuarbeiten. Die europäische Integration ist ein dynamisches Forschungsgebiet, dessen Bearbeitung einerseits einen hohen Einsatz an personellen Ressourcen und andererseits ein breit abgestütztes, interdisziplinäres Vorgehen voraussetzt. Das CEI will durch wissenschaftliche Analyse der die europäische Integration prägenden normativen Strukturen einen Beitrag zur Europaforschung auf exzellentem Niveau leisten. Website FZ Europäische Integration

Im Rahmen des Forschungszentrums sollen die Forschungsaktivitäten der Universität Innsbruck im Bereich der Föderalismusforschung gebündelt, intensiviert und weiter ausgebaut werden. In Zusammenarbeit mit dem Institut für Föderalismus in Innsbruck sowie dem Institut für Föderalismus- und Regionalismusforschung der EURAC Bozen soll das Forschungszentrum zu einem führenden Standort interdisziplinärer und grenzüberschreitender Föderalismusforschung werden. Website FZ Förderalismus - Politik und Recht

Das Forschungszentrum (FZ) Gesundheit und Prävention über die Lebensspanne verbindet Fachbereiche am Institut für Psychologie und am Institut für Sportwissenschaft sowie affiliierte Kooperationspartner:innen an der Medizinischen Universität Innsbruck, die präventions- und gesundheitsrelevante Forschungsschwerpunkte beinhalten.

Als übergreifendes Modell des FZ Gesundheit und Prävention über die Lebensspanne wird ein biopsychosoziales Modell postuliert das gekennzeichnet ist durch einen interdisziplinären Forschungsansatz. Der kohärente theoretische Hintergrund ist geprägt durch gesundheits- und präventionsrelevante Foki zur Identifizierung von Resilienz- und potentiellen Risikofaktoren für die psychische und körperliche Gesundheit in allen Altersgruppen. Website FZ Gesundheit und Prävention über die Lebensspanne

Das Forschungszentrum HiMAT (History of Mining Activities in Tyrol and adjacent areas – impact on environment and human societies) wurde 2007 an der Universität Innsbruck eingerichtet und ist aus einem vom FWF geförderten Spezialforschungsbereich (SFB) hervorgegangen. Das Forschungsprogramm setzt sich mit den Auswirkungen des Bergbaus auf die Kulturen und die Umwelt im Alpenraum vom Neolithikum bis in die Neuzeit auseinander. Beteiligt sind international ausgewiesene Expert:innen aus verschiedenen historischen Wissenschaften sowie aus zahlreichen natur- und ingenieurswissenschaftlichen Disziplinen, wobei die Einbindung des wissenschaftlichen Nachwuchses ein besonderes Anliegen ist. Im Rahmen eines interdisziplinären Netzwerkes mit internationaler Beteiligung werden die Entwicklungsphasen des Montanwesens im mittleren Alpenraum systematisch untersucht. Website FZ HiMAT

Das Forschungszentrum „Innovative Baustoffe, Bauverfahren und Konstruktionen“ bündelt die Kompetenzen im Bereich der Ingenieurwissenschaften, die notwendig sind um neue Bauarten, Bauverfahren und Konstruktionen zu entwickeln. Die Bildung des Forschungszentrums gründet auf der Erkenntnis, dass nennenswerte Weiterentwicklungen nur durch die Bündelung der Vorteile unterschiedlicher Baustoffe in gemeinsamen Konstruktionen und in der Zusammenarbeit zwischen Materialtechnologie, den konstruktiven Fächern Betonbau, Holzbau und Metallbau sowie unter Berücksichtigung der baubetrieblichen Anforderungen erzielt werden können. Ein weiterer wesentlicher Aspekt, nämlich die Nachhaltigkeit unserer Konstruktionen, wird durch die Berücksichtigung der bauphysikalischen Anforderungen sowie durch die Anforderungen des effizienten Einsatzes von Energie berücksichtigt. In diesen Bereich fällt auch die vermehrte Beschäftigung mit sog. Life – cycle – Analysen (LCC), die den kompletten Lebenszyklus von Konstruktionen betrachten und in der Regel nur fächerübergreifend zu belastbaren Ergebnissen führen.

Der Rechtswissenschaftlichen Fakultät ist es ein Anliegen, ihr Profil mit Blick auf die Rechtsordnung des Nachbarstaates Liechtenstein zu schärfen. Damit soll nicht nur das – auch im aktuellen Entwicklungsplan – niedergelegte Selbstverständnis unserer Universität als „Landesuniversität“ ua für das Fürstentum Liechtenstein unterstrichen und mit weiterem Leben gefüllt werden. Darüber hinaus sollen konkrete Interessen in Forschung und Lehre bestmöglich verfolgt werden. Den Ausgangspunkt bilden bereits langjährig bestehende, von Wissenschaftler:innen unterschiedlicher Institute unserer Fakultät ausgehende Aktivitäten sowohl in Forschung, Lehre als auch in der Praxis, die künftig besser sichtbar gemacht und durch Bündelung noch attraktiver gestaltet und weiterentwickelt werden sollen. Website FZ Liechtensteinisches Recht

Die Universität Innsbruck versteht sich als Landesuniversität unter anderem auch für das Fürstentum Liechtenstein. Die Rechtswissenschaftliche Fakultät hat diesem Selbstverständnis mit der Gründung des Forschungszentrums „Liechtensteinisches Recht“ Rechnung getragen. Das DK fügt sich konsequent in diesen Rahmen ein: Es ist in das genannte Forschungszentrum eingebunden und versteht sich somit als Bindeglied zwischen Lehre und Forschung im Liechtensteinischen Recht an der Universität Innsbruck. Dabei kann das DK neben der regen Forschungstätigkeit auf die bereits seit vielen Jahren bestehende Kompetenz der Rechtswissenschaftlichen Fakultät in der Abhaltung von Lehre und der Betreuung von Abschlussarbeiten im Bereich des Liechtensteinischen Rechts aufbauen. Zudem weist die Rechtswissenschaftliche Fakultät der Universität Innsbruck einen einzigartigen Standort im Zentrum der Verbindungslinien zwischen jenen Rechtsordnungen auf, die das Liechtensteinische Recht prägen (nämlich österreichisches, deutsches, italienisches und eidgenössisches Recht). Website DK Liechtensteinisches Recht

An der rechtswissenschaftlichen Fakultät wird seit Jahrzehnten im Bereich Medizinrecht geforscht und seit 2002 auch regelmäßig gelehrt. Um die an der Fakultät auf verschiedenen Fachgebieten laufenden Arbeiten im Bereich „Medizin- und Gesundheitsrecht“ zu bündeln und zu verstärken, wurde dieses Forschungszentrum eingerichtet. Damit können die Aktivitäten an der Fakultät nicht nur institutsübergreifend intensiviert werden, das FZ soll auch eine zentrale Plattform für Kooperationen mit anderen Fakultäten und Hochschulen (insbesondere der MUI und der UMIT) bilden, von der aus etwa Forschungsprojekte, Publikationen und Tagungen besser koordiniert werden können. Website FZ Medizin- und Gesundheitsrecht

Im Rahmen des Doktoratskollegs (DK) erhalten die Doktorand:innen eine fundierte medizinrechtliche Ausbildung. Diese soll sie insbesondere für weitere wissenschaftliche Betätigungen in diesem Forschungsfeld sowie für die Rechtspraxis im Bereich des Medizinrechts und Gesundheitswesens qualifizieren. Die aus dem DK hervorgehenden Dissertationen sollen als hochwertige wissenschaftliche Arbeiten publiziert werden und damit die Weiterentwicklung in diesem Bereich positiv fördern.

Das DK stellt ein Bindeglied zwischen Lehre- und Forschung im „Medizin- und Gesundheitswesen“ dar. Über die Einbindung in das Forschungszentrum ist dabei nicht nur eine exzellente Betreuungssituation garantiert, sondern die Doktorand:innen werden durch die Einbindung in das DK und dessen Einbindung in das Forschungszentrum vielfach profitieren: sie erhalten dadurch Zugang zu einer internationalen wissenschaftlichen Community, zu einschlägigen Lehrveranstaltungen, zu nationalen und internationalen Fachveranstaltungen (zB Kongresse, Workshops) sowie zu verschiedensten Forschungsinstitutionen (Bibliotheken, Datenbanken etc). Sie sollen frühzeitig die Möglichkeit haben, Vorträge auf wissenschaftlichen Tagungen zu halten und einschlägig zu publizieren und werden dabei finanziell durch die Mittel des DKs unterstützt. Website DK Medizinrecht und Gesundheitswesen

Das interfakultäre Forschungszentrum "Nachhaltiges Bauen" beschäftigt sich mit dem Konzeptionieren, Entwerfen, Planen und Bauen von urbanen und ländlichen Strukturen, Gebäuden und Freiräumen für eine energie-, umwelt- und ressourceneffizienzente Zukunft.

Die gebaute Umgebung ist Spiegelbild unserer Gesellschaft, prägt den Großteil unseres Lebens und beeinflusst unsere Lebensqualität. Gebäude bieten uns Wohn- und Arbeitsräume sowie Schutz vor äußeren Einflüssen. Die dazwischenliegenden Freiräume und Landschaften werden für Freizeit und Mobilität genützt. Gewerbliche, kommerzielle und soziale Infrastrukturen sind in städtische und ländliche Strukturen eingebettet. Der Wohnungsbestand in Österreich hat sich in den letzten 50 Jahren verdoppelt.

Das Ziel des Innsbruck Center for Philosophy and Religion ist es, exzellente Forschung und Nachwuchsförderung in allen Bereichen der akademischen Religionsphilosophie sowie in der für religionsbezogene Forschung relevanten philosophischen Grundlagenforschung zu bündeln und zu fördern. Seine allgemeine Aufgabe sieht es in der philosophischen Erforschung des Verhältnisses von Religion und Rationalität sowie von Glaube und Vernunft, bezogen auf sämtliche in diesem Kontext einschlägige Fragen von theoretischer und praktisch-gesellschaftlicher Relevanz. Ein besonderes Anliegen des Centers ist dabei die Förderung interreligiöser Diskurse und des interreligiösen Dialogs in Österreich und im inner- und außereuropäischen Ausland. Neben der akademischen Forschung fördert das Center Transferleistungen in den außeruniversitären Raum (Outreaching), z. B. durch Vorträge, Konferenzen in Akademien (die das Institut bereits regelmäßig bestreitet), durch Auftritte in den elektronischen und nicht-elektronischen Medien usw. Die im Umfeld des Centers verfolgten wissenschaftlichen Aktivitäten. Website FZ Philosophy of Religion

Religion and religious faith are among the most powerful forces behind human culture and collective or individual striving for moral and spiritual transformation. Yet, as critics emphasize, at the same time religions have been and continue to be misused for reprehensible aims, such as to cement illegitimate political power or foment violence and discrimination. It is thus an urgent philosophical task to understand the nature of and rationality conditions for faith and religion in their multifaceted cognitive and cultural dimensions, as well as in their various spiritual, practical, and affective aspects.

The Doktoratskolleg/Doctoral College Philosophy of Religion (hereinafter referred to as ‘DCPR’), which is affiliated with the Innsbruck Center for Philosophy of Religion (ICPR), promotes high-quality philosophical research, and across a wide range of philosophical approaches, on religion and religious belief. Members need not be religious or be committed to any particular religious tradition or denomination. The DCPR fosters research projects across different religions and is committed to advancing rational religious discourse and interreligious dialogue. Website DK Religionsphilosophie

Zur Lösung der ‚Drei Superchallenges des 21. Jahrhunderts‘, (1) Anstieg der atmosphärischen Klimagase, (2) Energiekrise, (3) Nachhaltige Nutzung der Ressourcen (Wasser, Böden, Pflanzennährstoffe, Biomasse) beizutragen ist unser Handlungsmotiv.

Atmosphärische Klimagase und deren Wechselwirkungen mit biologischen Produzenten und Destruenten sind ein Spielfeld von CERB, insbesondere mit der PTR-MS Technologie auch durch flugzeuggestützte Messungen des Instituts für Ionenphysik und Angewandte Physik. Einen Link zwischen Biologie und Physik/Chemie bieten die Echtzeitanalyse organischer Aerosole sowie zum katalytischen Abbau von persistenten Umweltschadstoffen. Am Institut für Analytische Chemie und Radiochemie werden analytische Verfahren auf Basis hochselektiver Trenn- und Anreicherungsprozesse und IR-Spektroskopie im nahen- (NIR) und mittleren (MIR) Bereich, sowie die ATR (Attenuated Total Reflection) vorangetrieben, mit Hauptvorteilen liegen in der zerstörungsfreien Analyse.

Das Doktoratskolleg Biointeractions - from basics to application (BioApp) hat es sich zum Ziel gesetzt, zur Aufklärung von Interaktionen verschiedener prokaryotischer und eukaryotischer Organismen untereinander, mit Pflanzen und Tieren, als auch mit ihrer abiotischen Umwelt (von der Art- bis zur Domänenebene) beizutragen. Diese Interaktionen sind zum Großteil noch wenig erforscht, obwohl sie für natürliche Ökosysteme extrem relevant sind, und auch maßgeblich biotechnologische Prozesse beeinflussen, von der Abwasserreinigung, Biogasproduktion und biologischen Altlastensanierung bis hin zur Agrobiotechnologie. Website DK Biointeractions from Basics to application